Launched in 2015, Ethereum is a programmable blockchain technology with smart contract functionality. When people talk about trading Ethereum, they’re actually talking about trading ‘Ether’ – a tradable token designed to fuel the Ethereum ecosystem.

Compare Accounts For Buying & Selling Ethereum

Use our comparison table of Ethereum accounts to compare costs and the different ways to buy and sell Ethereum. Please Note: Investing in Ethereum and other cryptocurrencies is very high risk and not regulated by the FCA. There is a very high chance you may lose all your money.

The 1% fee for trading crypto is included in the buy-sell spread when you trade crypto.

Fees for buying and selling vary between assets and depend on whether you are a buyer or seller.

Revolut Cryptocurrency Trading

Simple Ethereum account for smaller traders

Buy, sell, and send Ethereum and other digital currencies at the touch of a button, with no hidden fees. Revolut’s cryptocurrency service is not regulated by the FCA, other than for the purposes of money laundering. Capital at risk

Crypto fees are reduced to 1.5% for Metal and Platinum account holders.

Ethereum Broker Finder

An Ethereum broker can help facilitate large Ether transactions of over £250,000. Ethereum brokers differ from standard cryptocurrency accounts in that as well as providing an online platform for Ether trading they provide personal account managers to help with complex and large transactions. Whilst Ethereum is not regulated in the UK, we have partnered with institutional brokers who are attached to regulated firms that can provide cryptocurrency brokerage services.

We will never pass on, share or release your details to any third party unless you specifically ask us to. For more information see our full privacy policy. There is no cost for using our services. We act as an introducing agent to regulated brokers and may receive a form of commission or rebate for referring business.

Ethereum Explained:

Crypto digital assets are disrupting the current global financial system. Ethereum is a major part of this digital paradigm shift. But what is Ethereum and how can we learn to harness its power? This guide talks about Ethereum, and the risk and rewards of investing in the second-largest crypto network in the world.

What is Ethereum?

Ethereum is an open-source digital platform. Think of it as a network of computers running synchronized software.

While Ethereum is less than 10 years old, it is a significant part of the crypto ecosystem. It is the second-largest crypto after Bitcoin. In fact, Ethereum is so popular these days that the total value of Ethereum tokens is currently worth nearly $300 billion – a market cap higher than all but 25 public companies in the world.

Ethereum was founded in 2014 by Vitalik Buterin (then age 20!) and a group of uber-smart programmers like Wood, Hoskinson, Iorio, and Lubin (see the original Ethereum White Paper here). Since then, the Ethereum system has grown into a major crypto platform.

Ether (ticker: ETH) is the ‘native currency’ of the Ethereum platform and serves, in Vitalik’s words, as the ‘main crypto-fuel of Ethereum’. ETHs are used to pay for transactions on the Ethereum platform. So when we talk about the price of Ethereum, we actually refer to the price of Ether.

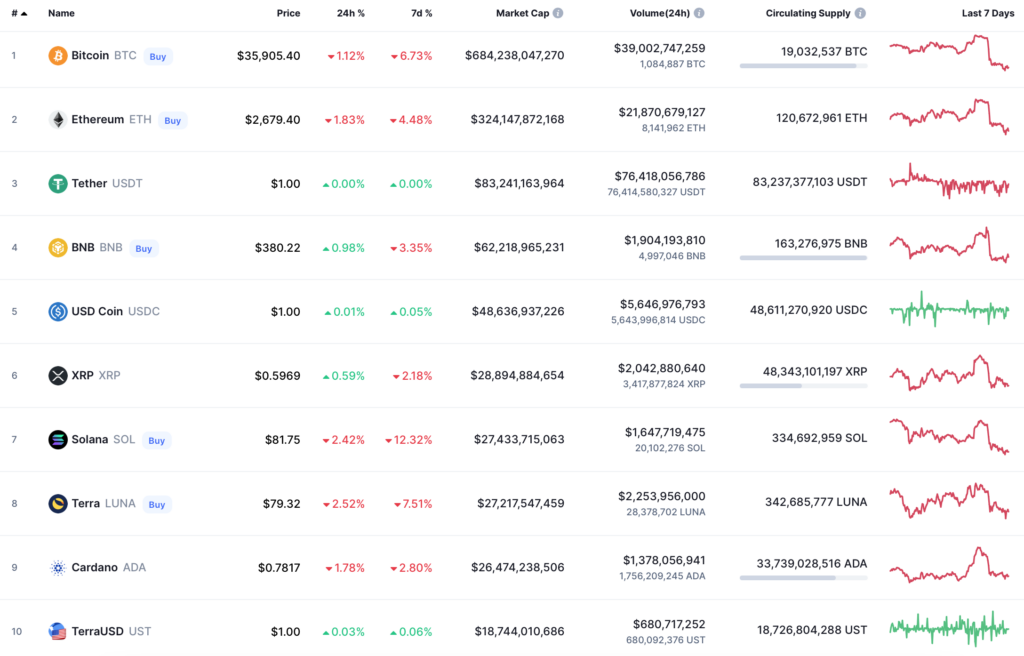

Source: Coinmarketcap.com (May ’22)

Ethereum is a decentralised network of computers (‘nodes’) built upon blockchain. As noted in our Bitcoin Primer, blockchain is a distributed ledger system (DLT). It comprises of a network of hosting nodes where user data is stored. No one controls Ethereum in the traditional way.

From the outset, Ethereum was designed to meet challenges outside the core competencies of Bitcoin. It lays the framework so that useful applications can be built on top of it. As more people joined the platform, Ethereum gained from the ‘Network Effect‘ – its success is proportional to the number of users.

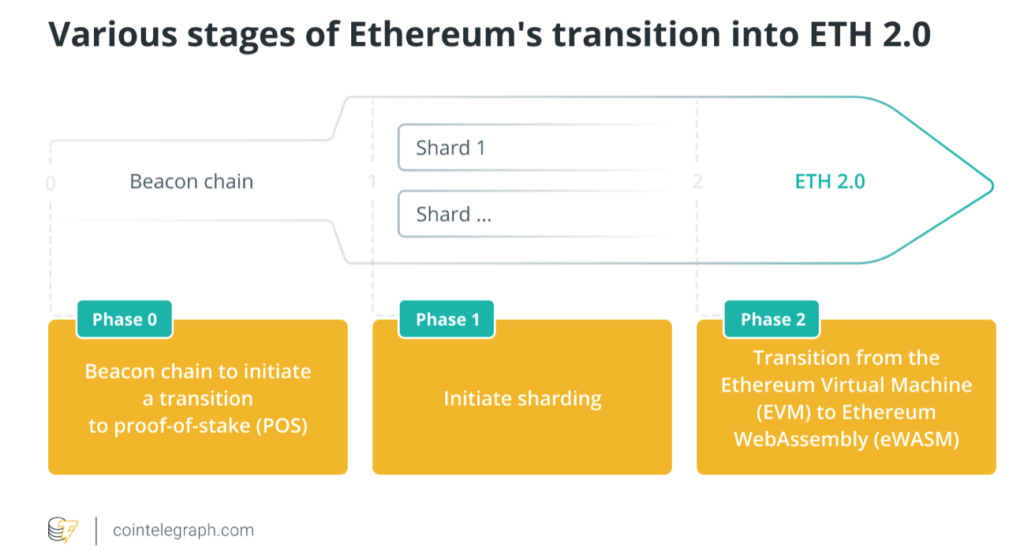

Major upgrades are set to happen in the near future (Beacon Chain) to make the Ethereum platform even more scalable and secure. Ethereum is set to change from ‘Proof of Work‘ (PoW) – whereby miners solved complex puzzles to obtain ‘rewards’ in the form of Ether tokens – to a ‘Proof of Stake’ system. In this system, validators earn tokens by validating contracts on the Ethereum platform. This change is highly complicated because it requires the platform to maintain integrity during the transition.

Source: Cointelegraph.com

What can Ethereum be used for?

Ethereum is a decentralised system that can facilitate cryptographically-verified transactions. So it can be used for a lot of real-life situations.

At its fundamental level, Ethereum supports ‘smart contracts‘ – which, in simplest terms, is a series of computing instructions. These instructions are executed when certain conditions are met. For example, X sends $100 to Y on 16 May 2022 at 10.00am.

Smart contracts are first coded in computing languages, of which the most popular is Solidity (latest version 0.8.13), and then deploy in the Ethereum network.

But where exactly are these smart contracts executed? Typically these instructions are performed on the Ethereum Virtual Machine (EVM) – the environment that executes on each Ethereum node and carries out smart contract instructions (see here for a further explanation of EVM). Once deployed, these smart contract programs are immutable – another word for ‘unchangeable’.

Each node (computer) in the Ethereum network can run these programs and get the same result. Note that these contracts are dormant (like a vending machine). They will be activated when triggers are hit (like someone putting a coin in the vending machine). Since smart contracts are on public domain, anyone can check if the transaction happened.

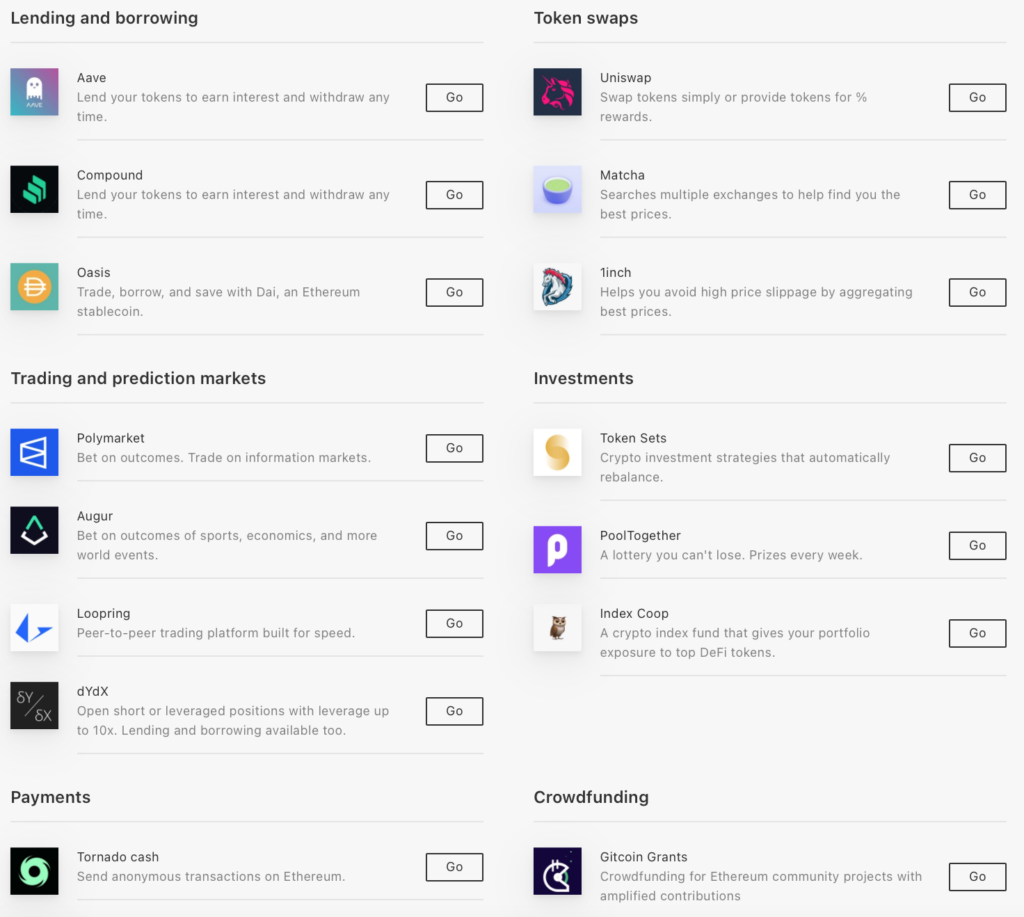

Smart contract platforms like Ethereum are used to build on other applications. According to Ethereum.org, below is a sample of what these codes are used in:

Source: Ethereum.org

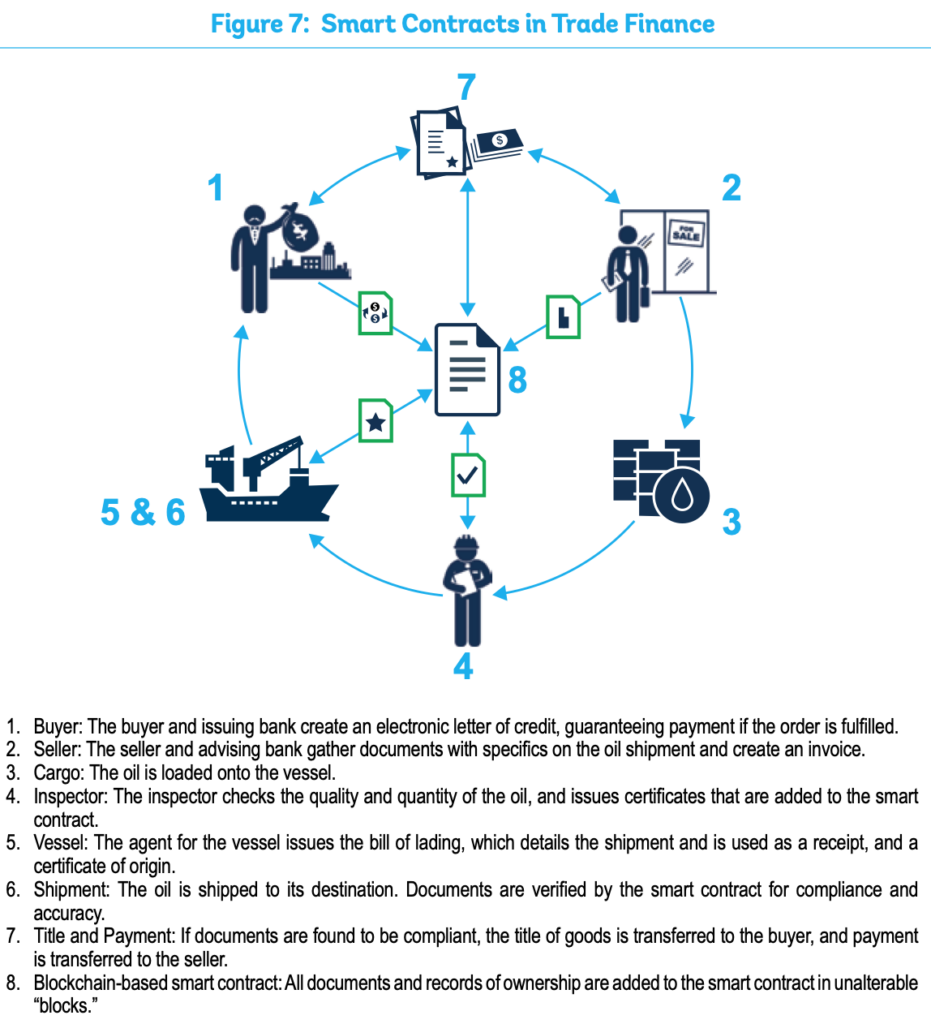

Another real-life example of smart contracts is trade finance. As we all know, international trading is a highly complex process because we need to deal with customs, port authorities, multi-national financing and legal demands.

But with pre-agreed terms and conditions, the process can become easier. Enterprise blockchain platforms like C.rda (corda.net), Hyperledger Fabric (Hyperledger.org/use/fabric), Quorum (consensys.net) have sprung up to capture this market. Once trust is gained on these platforms, more users will join them.

Source: World Bank

Is there a business case for the Ethereum platform?

Definitely. And the potential market is becoming larger by the month.

Businesses can take advantage of the decentralised and immutable nature of the Ethereum platform. Two major uses include:

- Decentralised finance (Defi) – where brokers, middlemen, expensive transfer fees are either eliminated or reduced. Currently, the finance industry is driven by centralised institutions (think central banks and big banks). DeFi emphasises peer-to-peer networks that promotes business transactions through the blockchain technology.

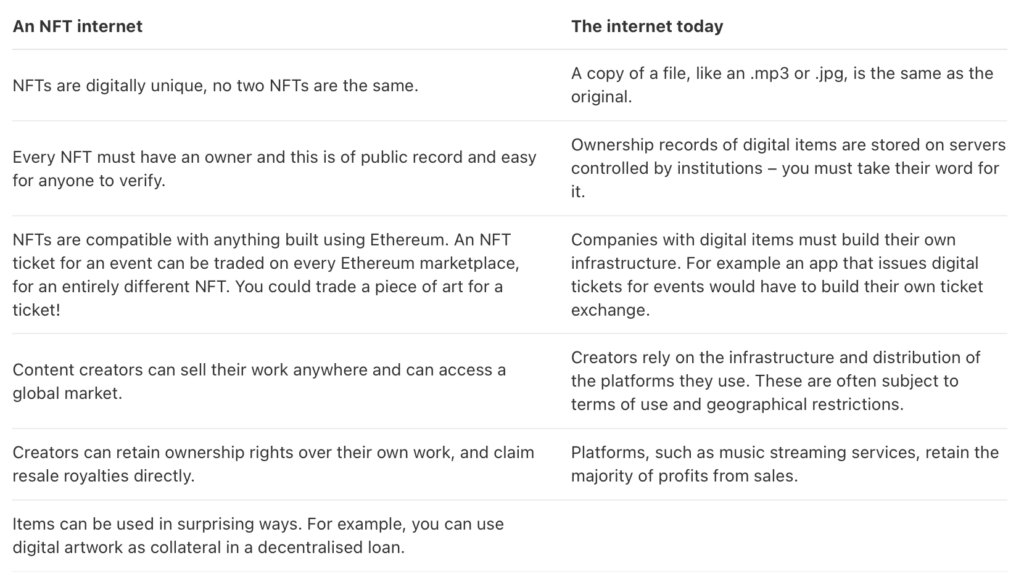

- Non-Fungible Tokens (NFT) – are immutable pieces of data that can be part of a digital art. Promoters of NFT will uses Ethereum to sell unique ownership of ‘valuable’ pieces of items. A comparison of what an NFT is showed below:

Source: Ethereum.org

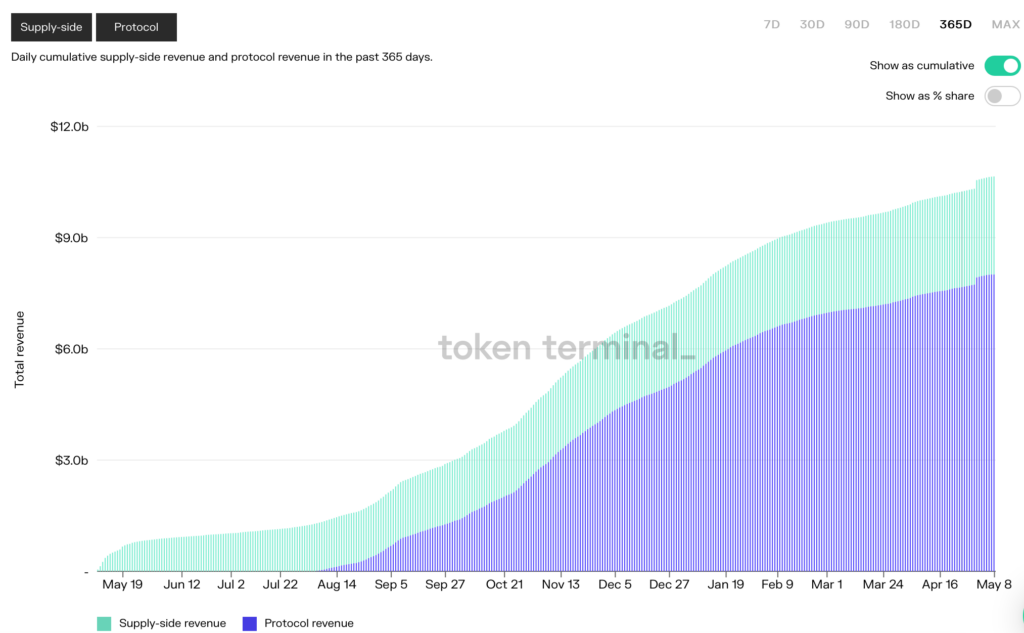

As more users operate on the platform, recurring revenue will rise over the quarters and years. As you can see from this chart, the Ethereum protocol is estimated to have generated $640 million of revenue in the past thirty days alone – with annualised revenue running about in the region of $7-8 billion.

Source: tokenterminal.com

What are the risks involved buying Ether?

Investments always carry risk. It is only a matter of degree. Crypto assets in general are high-risk because they are new, speculative, and volatile.

First, the price of Ethereum is highly correlated with Bitcoin, itself highly correlated with Nasdaq. The reason for this is obvious: The deepening involvement of institutional investors. For better or worse, Bitcoin is now viewed as a ‘macro asset’. As such, its price will swing violently during macro events, such as FOMC meetings. Just recently, Bitcoin and Ethereum prices plunged when the Nasdaq sank. To diversify your tech-heavy equity portfolio by buying BTC and ETH is an illusion.

Second, in contrast to Bitcoin, Ethereum does not have a concrete cap on coin supply. Hence ETH is less attractive in terms of scarcity. Unsurprisingly, Michael Saylor of Microstrategy (MSTR) prefers to buy Bitcoins over Ethereum. Is Ethereum a ‘hard asset’ like Bitcoin? That depends on your perspective. Moreover, Ethereum ‘Whales’ control a significant portion of ETH supply. Note this: The top 100 Ethereum addresses hold nearly 40% of the entire ETH tokens.

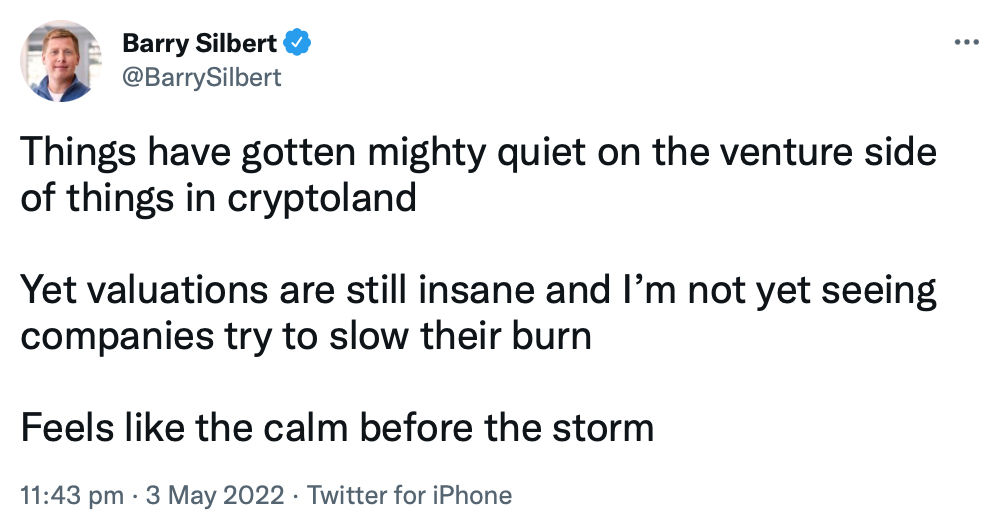

Third, Ethereum prices are hugely volatile. Yes, prices rose 50x from its March 2020 lows. But since that $4,800 peak, it lost 50% of its value. Investors who bought during the FOMO phase (Fear of Missing Out) could be sitting on steep losses for some time. In recent days, even some crypto heavyweights issued warnings about a looming crypto winter, such as the billionaire Barry Silbert of Digital Currency Group:

Source: Twitter (Barry Silbert)

Fourth, Ethereum faces competition from other crypto currencies, such as Solana (SOL, market cap $25 billion) and Cardano (ADA, market cap $23 billion). Over time, new competitors will emerge, although it is hard to see what could topple the entrenched Ethereum protocol in the near term.

Lastly, hacking is still an issue. A couple months ago, Ronin Network lost about $600 million to hacking. This is a persistent issue in the industry. Keys to wallets can be lost by users, or stolen, or just mugged in the streets (‘crypto muggings‘).

All in all, even a ‘blue chip’ crypto like Ethereum presents many investment risks. Do not go ‘all in’ at any point. Chances are, you will not capture the bottom of a bear trend.

What are the potential rewards of investing in Ether?

The crypto industry is one of the fastest-growing assets in the world. Thousands of innovators, capitalists, sovereign and banking institutions are flocking into the system to stake a claim on its future output.

After two major epic booms (2017, 2021), many early adopters and businesses have become extremely rich. For example:

- Coinbase (US: COIN) – a major crypto platform, had one of largest IPOs at $80+ billion in 2021

- Binance – owner of Binance, Zhao, was listed as one of the richest billionaires worth $74 billion

- Microstrategy (US:MSTR) – saw its share price soar 10x in 2020/21 when its CEO bought BTC in the billions

- FTX – the 29-year old Sam Bankman-Fried owns the $30 billion enterprise exchange

- Bitcoin Billionaires – Many astute entrepreneurs made a fortune in the crypto around the world as the sector booms

These are just some outstanding examples. Many crypto enterprises are expanding fast globally under the cover, just like the above early pioneers. In the years to come, we will no doubt see new crypto giants emerge from the sector.

The bears will, of course, argue that these fantastic riches (the lowest hanging fruits) have already been picked. Joining the sector now is like starting a social network post Facebook. This will not work as current giants will buy out every emerging competitor on the horizon.

True. But over the long term and certainly over a couple of up-and-down cycles, crypto is still a growing network. Adoption of the network is rising globally. A popular network like Ethereum will continue to flourish because more users are joining it. Just recently $10 billion of Ether tokens are deposited in the network for staking. This is a huge vouch of confidence.

Therefore, the reward for investing part of your portfolio into crypto may be substantial if you play the game right.