We have ranked, reviewed and compared the best UK share trading platforms let you buy and sell UK companies via CFDs or spread bets so you can potentially profit in the short-term when they go up as well as down and trade on leverage to maximise your risk capital. Share trading differs from share dealing, which is more geared to buying UK shares for long-term capital growth and dividends.

City Index: UK share trading signals and post-trade analysis

- Costs & spreads: 0.08%

- UK shares available: 5,000

- Overnight financing: 2.5% +/- SONIA

- Account types: CFDs & spread betting

69% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: UK share trading on MT4

- Costs & spreads: 0.1%

- UK shares available: 192

- Overnight financing: 2.5% +/- SONIA

- Account types: CFDs & spread betting

75.3% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: UK share trading with personal service

- Costs & spreads: 0.1%

- UK shares available: 1,575

- Overnight financing: 3% +/- SONIA

- Account types: CFDs & spread betting

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Discount UK share trading & investing

- Costs & spreads: 0.02%

- UK shares available: 500

- Overnight financing: 1.5% +/- SONIA

- Account types: CFDs, DMA & investing

60% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers is the best UK share trading platform based on our testing. IBKR has some of the most advanced order functionality for working large UK share trades, including VWAP, iceberg, pairs trading and drip feeding.

CMC Markets: High-tech UK share trading platform

- Costs & spreads: 0.1%

- UK shares available: 745

- Overnight financing: 2.9% +/- SONIA

- Account types: CFDs & spread betting

74% of retail investor accounts lose money when trading CFDs with this provider

XTB: Good UK share trading educational material

- Costs & spreads: 0.08%

- UK shares available: 230

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Account types: CFDs

81% of retail investor accounts lose money when trading CFDs with this provider

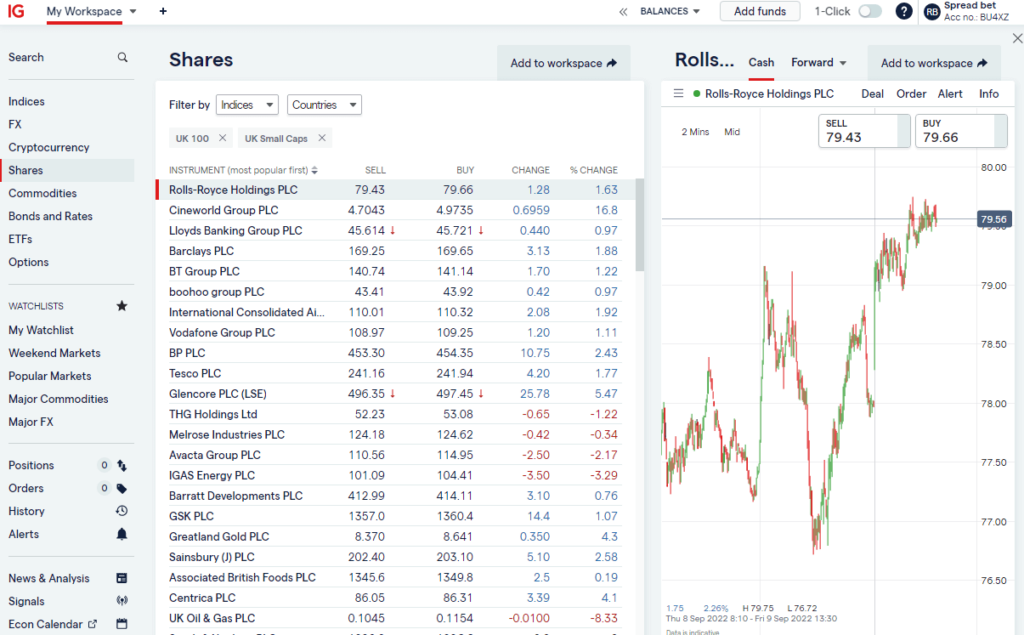

IG: Deep share trading liquidity & market range

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG is one of the best UK share trading platforms based on our data matrix and analysis as they offer the most UK companies (large and small), through the most account types (CFD, spread bet and investment) as well as provide a huge amount of analysis, news, trading signals and have an industry-leading online and mobile trading platform. They also provide DMA CFD trading for higher volume and advanced traders.

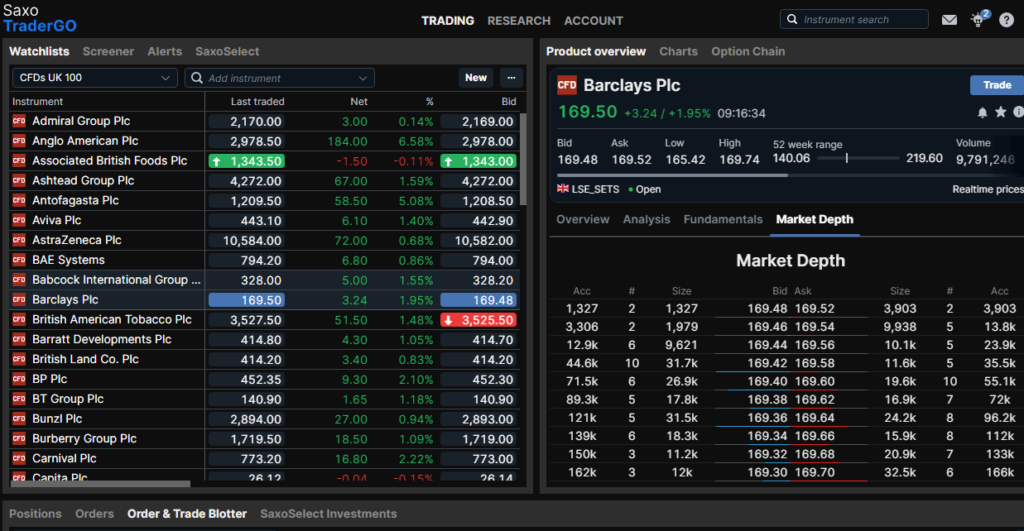

Saxo Markets: Professional grade UK share trading platform

- Costs & spreads: 0.05%

- UK shares available: 3,500

- Overnight financing: 2.5% +/- SAXO RATE

- Account types: CFDs, DMA & investing

70% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets is the best broker for UK share trading with direct market access. Their SaxoTraderGo platform offers access to both UK shares to physical investing, CFD trading and also UK share options.

eToro: Copy other people’s UK share trading

- Costs & spreads: 0.15%

- UK shares available: 292

- Overnight financing: 6.4% +/- SONIA

- Account types: CFDs & investing

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

❓Methodology: We have chosen what we think are the best UK share trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the UK share trading platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the share trading platform CEOs and senior management

In our comparison of UK share trading platforms you can see how much a broker charges when you go long or short shares as well as how much they charge for holding positions overnight. You can also compare how many UK shares are available on their platform as well as if they offer access to UK shares through CFDs, spread betting, have direct market access and also offer longer-term investing accounts.

Compare UK Share Trading Platforms 2024

| UK Share Trading Platform | UK Shares Available | UK Share Trading Costs | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 5,000 | 0.08% | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 192 | 0.1% | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 3,925 | 0.1% | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 1,575 | 0.1% | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 3,500 | 0.05% | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 745 | 0.1% | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 500 | 0.02% | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.15% | 292 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 230 | 0.08% | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 5,000 | 0.08% | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. |

How to choose a UK Share trading platform?

The main things to consider when choosing a broker for trading UK shares are:

- Pricing – how much do the broker charge per trade

- Market access – how many UK shares are you able to trade on their platform

- Overnight financing – if you are trading on leverage what are the overnight costs

- Account types – can you trade on margin through CFDs and spread bets as well as invest in a SIPP, ISA or general investment account?

Advantages of using a UK share trading platform

- Regulated by the FCA and funds protected by the FSCS

- Leverage trading means you can get more exposure to the market

- You can go long and short to profit from rising and falling markets

- Profits from spread betting on UK shares are tax-free

- Do not have to pay stamp duty on OTC trades

Disadvantages of using a UK share trading platform

- It is hard to make money in the short-term compared to long-term share investing

- Losses from short positions are potentially unlimited

- Overnight financing means holding a position longer than a month wipes out stamp duty savings.

How can you trade UK shares?

The main three ways to trade UK shares are:

- Physical shares – where you buy and pay in full for company shares through a share dealing platform.

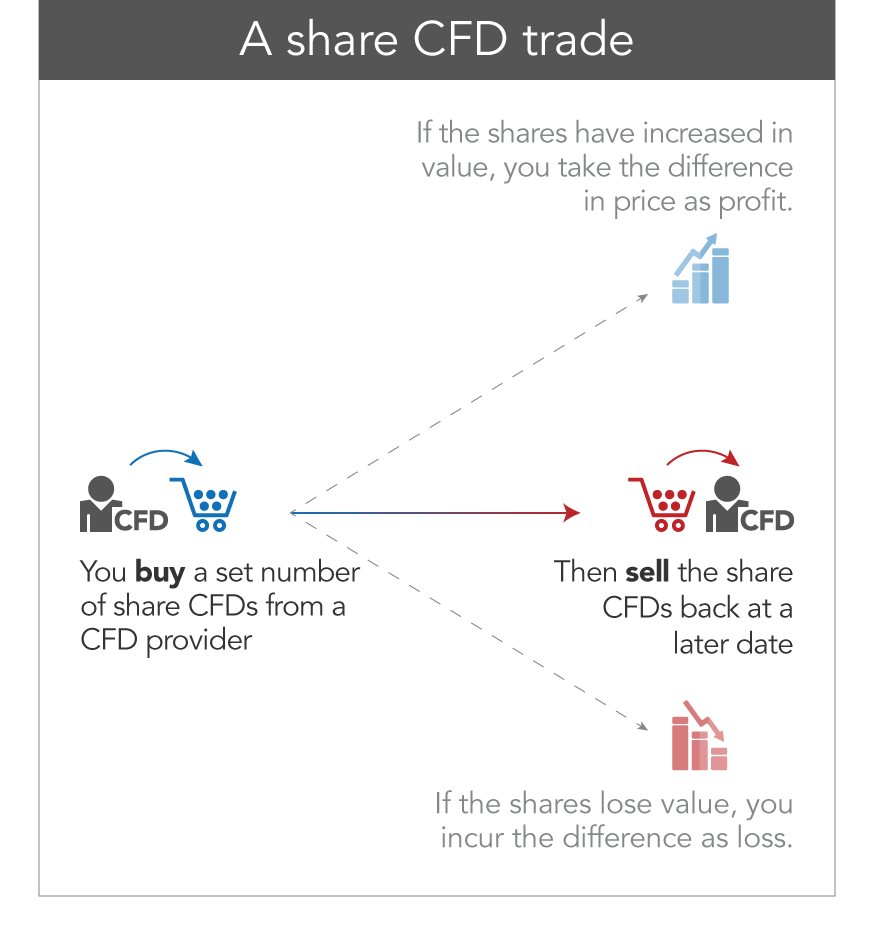

- CFDs – through a contracts-for-difference broker, where your profit and loss is based on the difference between the opening and closing price of a trade

- Spread betting – where you bet on the price movement of shares through a spread betting broker

Best UK Share Trading Platforms For CFDs & Spread Bets

IG often ranks as the best UK share trading platform for trading shares as a CFD or spread bet versus physical investing.

The main advantage of trading CFDs on stocks instead of physically buying them is that you can use leverage to increase your exposure. A stock with a deposit margin of 10% for instance would enable you to buy (or short) £10,000 worth with only £1,000 on account. CFDs for private and retail traders are generally used for short-term speculation rather than investing in the long term. You also have the ability of shorting stocks, meaning you can speculate on the price of a share going down as well as up.

The disadvantage of this of course is that as exposure increases, so does risk. By using leverage to trade it is possible to lose your entire account balance with just a 10% movement in the share price. As such the regulators are have put put limits on the amount of leverage private clients with limited experience have access to.

Share CFDs are generally not a good tool for longer-term positions as there is an overnight financing charge (as the broker is essentially lending you money to fund your position) of around 2.5% over the LIBOR rate. So holding a position any longer than a month or so becomes less economical than paying the stamp duty (0.5%) on normally stock broking purchases.

Private client CFD brokers like IG, Spreadex, and City Index, are execution only which means you have to make your own trading ideas. There are a few advisory CFD brokers around, but these should generally be avoided as brokers work on commission so have a vested interested in their clients trading more which is a conflict of interest.

Most retail CFD broker will earn revenue from clients by either widening the market spread or not hedging client positions.

Best UK Shares Trading Platform For DMA (Direct Market Access)

Saxo Markest has won our award for best DMA broker and is a good choice for traders that want direct market accounts to UK share exchanges.

For more experienced CFD traders getting direct market access is essential for trading UK shares. DMA, or direct market access mean that you work your orders direct on the exchange order book rather than trading from a CFD brokers widened price.

The main advantages of trading with DMA are that you get better prices because you can work limits inside the bid/offer. However, you are charged commission on trades, so must factor this in as an extra cost to your P&L.

DMA trading is also essential if you are a particularly big trader. Even in FTSE 100 stocks there is often not more than a few hundred thousand pounds worth of stock at the market price. If you are buying or selling a large position being able to nip away at the best price or work automated orders to drip feed your trades into the market are essential. This is called level-2 pricing and also shows you the market depth allowing you to execute orders more efficiently.

Best UK Share Trading Platform For Professional & Advanced Traders

Interactive Brokers offers some of the best execution and order types for trading UK shares and is a good choice for sophisticated traders.

For hedge funds, family offices or professional traders institutional CFD brokers like, IBKR & IG provide online execution platforms and experienced voice brokers to handle large orders than need finessing in the marketplace.

The key advantage for hedge funds using CFDs are a trading tool is that they provide anonymity as you don’t actually own the underlying assets of a CFD. You are just entering into a contract based on the different between the opening and closing price of a stock.

This was how CFDs were first used and gradually became available to private traders. For hedge funds and family offices looking for an institutional CFD broker you can compare prime brokers here using our interactive prime broker finder tool.

UK share trading FAQ:

UK shares traded on the London Stock Exchange are open in the main market between 8:00 to 16:30.

Yes, you can trade UK shares pre and post-market with most UK trading platforms. Brokers like IG, even offer UK share trading on the weekends.

Share trading is high-risk short-term speculation. Investing is when you buy shares in the long-term.

Yes, it is possible to make money trading UK shares is you predict the correct direction of the market.

However, If you are trading UK shares as a CFD or spread bet it is very risky as you are trading on margin. Typically only around 25% of retail traders make money trading UK shares this way.

The best UK shares to trade are the ones with the most liquidity and news flow. These are typically in the FTSE 100 which is the 100 most valuable companies listed on the London Stock Exchange.

NMS means the “normal market size” it refers to the maximum amount of shares a market marker is obliged to trade in one go.

The main types of UK share trading client are: retail clients (the majority of retail traders will fall into this category.), professional and, Institutional.

Yes, most trading platforms will have some information on trading signals. If yo are looking for inspiration on what stocks to buy and sell you can also see key indicators here:

- Shares that have recently had a daily breakout

- Shares that have recently climaxed (either at the top or bottom of a range)

- Shares that have recently displayed a “hi-lo” pole

- Shares with an overextended point and figure spike or tail

- Shares that have a short or medium-term reversal signal

- Shares with a recent moving average crossover

- Shares that are trading at 52-week highs

- Shares that a trading a 52-week lows

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the UK share trading via a non-affiliate link, you can view their equity trading pages directly here:

⚠️ FCA Regulation

All UK share trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK share trading platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature UK share trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.