- Overview

- Richard's Review

- Awards

- Video Demo

- Facts & Figures

- Customer Reviews

Spreadex Review

Name: Spreadex

Description: Spreadex is a financial spread betting broker that has been in operation since 1999. It was founded by ex-city trader Jonathan Hufford and unlike many of its peers, it is not based in London, but instead is headquartered in St Albans Hertfordshire. Spreadex offers both financial spread betting and CFD trading from the same account. The company has some 60,000 account holders and offers access to more than 10,000 financial instruments, including UK small-cap shares, where it is something of a specialist.

Is Spreadex a good broker?

Spreadex is one of the most established spread betting brokers. They focus on providing excellent customer service through experienced dealers and a trading platform built from scratch in-house. A good choice for those that like to spread bet.

Pros

- Spread betting & CFDs

- Smaller cap stock trading

- Great customer service

Cons

- Not publically listed

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.4Ratings Explained

- Pricing: Super competitive and not afraid to undercut the competition.

- Market Access: Excellent, lots of access to exotic derivatives and smaller cap stocks.

- Platform & Apps: All developed in house and quick to add new features.

- Customer Service: Personal service is what sets Spreadex apart from other brokers.

- Research & Analysis: A good mix of technical indicators on the platform and daily briefings from the financial dealing desk.

Richard’s Spreadex Review

There are two types of broker in the derivatives world, those who spot a gap in the market and try to exploit it, and those that are in it for the love of the business. With my broker’s hat on, and in my expert opinion, they are the latter. You can tell by the quality and turnover of their staff, the fact that they generate the majority of their business from referrals rather than a massive digital market budget and the longevity of their service, that if you are going to trade, they are a broker worth putting your business through.

Market access

First off, what can you trade? Spreadex started off offering financial spread betting, which (as I hope you’ll know if you are reading this review) is a tax-free way to trade the financial markets. Trades are structured as bets so you don’t have to pay capital gains tax on your profits. However, as the appeal of trading with a UK-based broker (for regulatory and financial security purposes) has increased, Spreadex introduced CFD trading for non-UK residents a few years ago.

You can trade over 10,000 markets with Spreadex, so, if you are more adventurous than most who just seem to want to tap away on Tesle and Netflix these days, they also have a huge range of smaller-cap shares to trade. A lot of brokers don’t offer these, as the majority of clients stick to the top ten traded instruments and tend to add markets when clients request them. However, going back to my point earlier about service, Spreadex has a huge range of markets available to trade, before you need them, not after you ask for them.

They also have a very good range of indices, with access to Asian and European markets, as well as the major UK and US markets. Options trading is fairly limited, you can only trade on the FTSE 100 (UK100) and DAX 40 (German 40), but you can write options (go short) with Spreadex, whereas some brokers only allow you to buy options.

You can trade the usual commodities, currencies, bonds and fixed-income markets (I don’t know why I still find the phrase Bund, Bobl and Shatz funny when looking at treasuries watchlists after all these years). If you want to have a punt on themes rather than individual assets Spreadex has a wide range of ETFs for placing sector bets on things like Healthcare, Cannabis, CyberSecurity and so on so you don’t have to buy a load of individual shares. However, most of the ETFs are US based, there are not that many UK or European ETFs which can be traded in the morning without having to wait for the Americans to get out of bed. There are also a few ETFs, that track markets like Saudia Arabia (where an outright index isn’t always available).

Spreadex Pricing, Charges & Fees

There isn’t much to say about pricing when it comes to reviewing decent brokers these days because they are all about the same, and that is to say, very competitive. Spreadex earns money by widening the spread from the bid/offer price and including commission in that. For UK stocks, this is 0.1%, so for example, if you buy 10,000 Lloyds shares with Spreadex, the spread will be 49.21/49.33 instead of 49.26/49.28. So £10,000 worth of Lloyds would cost you £4,933 instead of £4,928. So a £5k trade will cost you £5, a £10k trade will cost you £10, a £100,000 trade will cost you £100, and so.

With US stocks Spreadex have also recently capped the spread on larger stocks at $3.5 to make trading the US market cheaper. For example, they mark up spreads by 0.15% for stocks like Tesla, but the spread is capped at 3.5. So, if Tesla shares are $16922.5 offered, then if they were marked up by 0.15% the Spreadex offer price would be $16948 (rounded). But because spreads are capped at $3.5, you would buy at $16926. So if you are trading at £1 per point as a spread bet that is a saving of £22 on roughly a £17k trade versus a broker who charges the same but hasn’t capped their spreads.

If you are holding positions in the slightly longer term Spreadex charge 3% over under SONIA, which is not quite the cheapest, but still very low compared to other brokers like eToro for example, that charges 6.4% over/under SONIA. To put that in perspective, if you have £10,000 exposure with eToro with SONIA at 4% for a year, it would cost you £1,400 in overnight funding, but with Spreadex only £650.

For the major FX, commodity, and index markets, Spreadex are pretty much inline with everyone else.

Platform and apps

Way back when I first opened my account, I remember being sent a VHS video of a very charming curly-haired man standing on Primrose Hill (I think) with the City as a backdrop explaining the pros and cons of spread betting. But Spreadex has come a long way from just providing voice brokerage to having one of the best trading platforms out there.

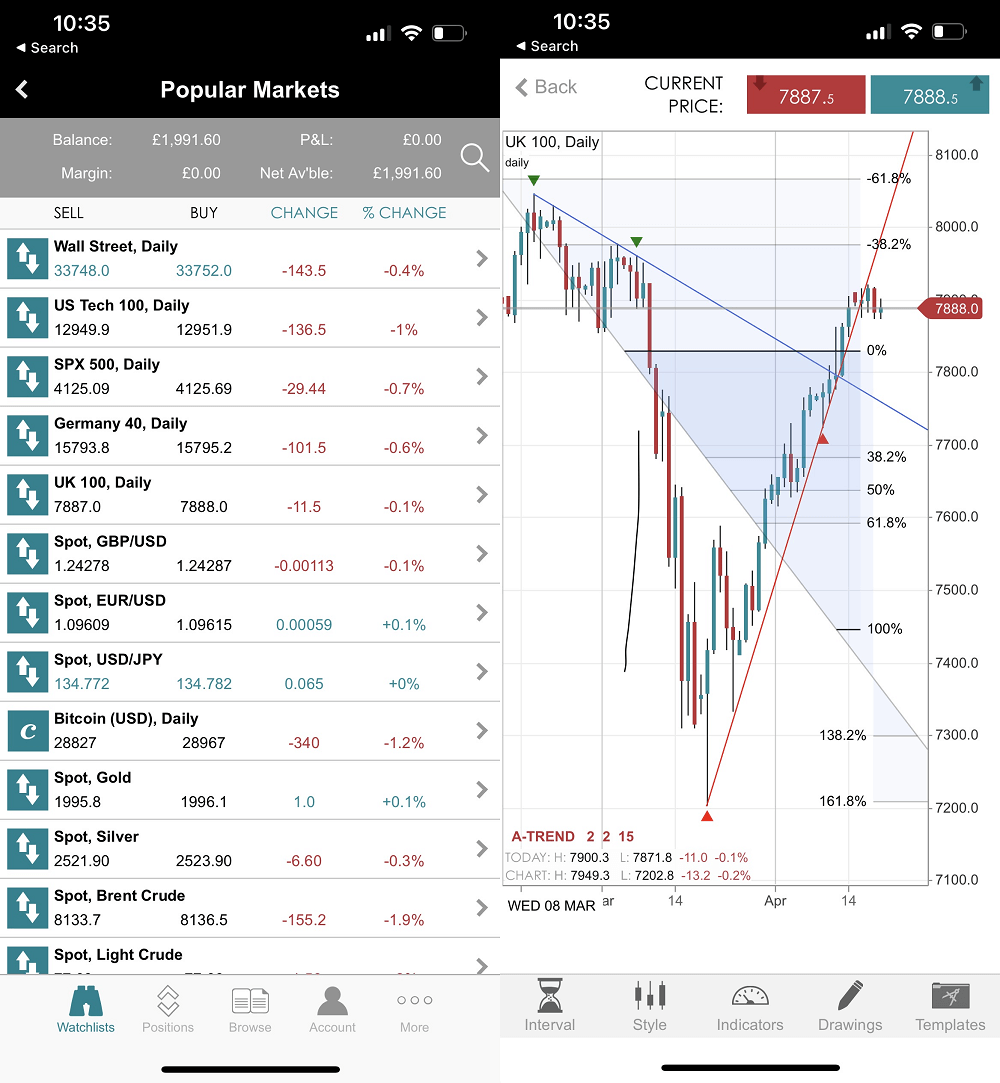

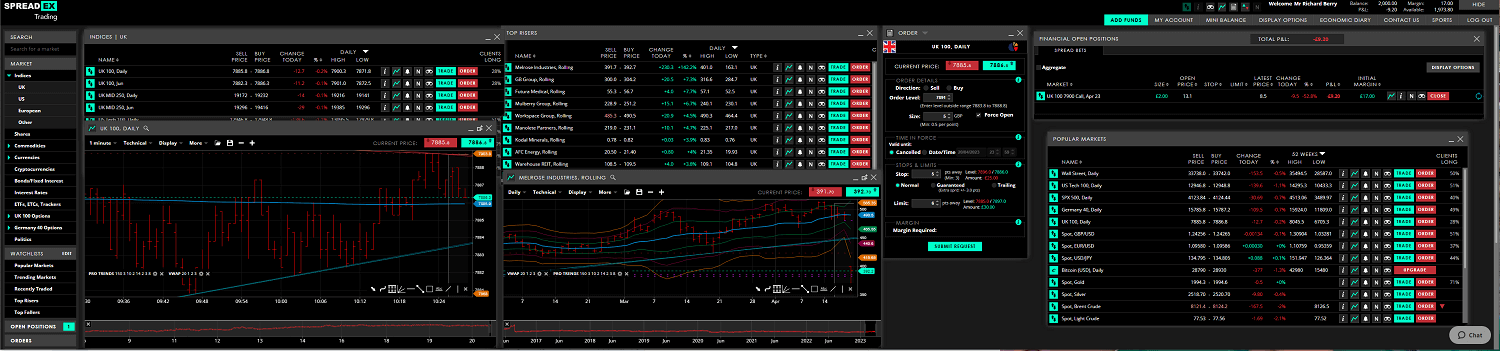

One thing I particularly like about the Spreadex trading platform is that it has been built and innovated inhouse. For exmaple, they have added the ability to overlay Pro Trend Lines, which automatically, add support and resistance levels, which takes a bit of the guesswork out of potential entry and exit points. You can also, overlay the VWAP, a price point, particularly useful, as it’s what hedge funds use for working daily orders that are well above the normal market size.

A nice feature of the Spreadex app is that you can change the columns from just change, to monthly and yearly high and low. Plus, should you, for some reason, want to do technical analysis on your phone instead of a proper computer, you can add indicators, free draw and overlay indicators like Fibonacci ranges whilst out and about.

There is a huge amount of technical indicators for advanced traders, but for beginners, they have all the usual range of risk management tools like stops, guaranteed stops (which protect you if the market gaps), trailing stops (so you can lock in profits the more profitable a position gets) and price alerts. More relevantly, though, if you are a beginner, and you don’t understand something, instead of having to wade through a quagmire of online educational resources, you can pick up the phone and ask for something to be explained.

It’s really a very good all-round trading platform that can cater for large customers as well as beginners. It’s simple, and modular so you can create your own desktop environment (if you’re trading on multiple screens). Plus, along with the rest of the world, Spreadex is now integrated with TradingView.

Research and analysis

There is also enough news flow to keep you informed and up-to-date with market news without getting overloaded. Through the app and web platform, you get access to the economic calendar of market-moving events, news filtered by product from Thomson Reuters, and trading updates from Spreadex dealers, highlighting the day’s key factors, and what traders should be aware of.

Customer service

One thing that has driven me mad over the past few years is that trading platforms seem to have become massively self-serving. In that, they are only interested in getting more customers, and onboarding traders, so that they can say they have seen massive growth and a race to the bottom for pricing. What this means, of course, is that there is too much emphasis on the platform and not enough on the client. For example, if you try and phone up most brokers, you can’t actually get through to anyone to ask a simple question from someone who knows what they are talking about. But, when writing this review, I needed clarification on a couple of points. First I used the chat box on the trading platform and got through to someone almost immediately, without even a whiff of an automated chatbot. Then, when I phoned the dealing desk for something else, the phone was picked by one of their dealers, who was very helpful and sent all the info I needed via email a few minutes later. For retail traders, you don’t really get that anywhere else.

Spreadex Awards

Spreadex have always done very well in our awards, they most recently won “best customer service” in our 2023 awards and have previously won “best spread betting broker” in 2019.

Spreadex Video Demo

Spreadex Facts & Figures

Spreadex Total Markets | 10000 |

| ➡️ Forex Pairs | 54 |

| ➡️ Commodities | 20 |

| ➡️ Indices | 17 |

| ➡️ UK Stocks | 1575 |

| ➡️ US Stocks | 2110 |

| ➡️ ETFs | 160 |

Spreadex Key Info | |

| 👉 Number Active Clients | 4000 |

| 💰 Minimum Deposit | 0 |

| ❔ Inactivity Fee | 0 |

| 📅 Founded | 1999 |

| ⬜ Public Company | ❌ |

Spreadex Account Types | |

| ➡️ CFD Trading | ✔️ |

| ➡️ Forex Trading | ✔️ |

| ➡️ Spread Betting | ✔️ |

| ➡️ DMA (Direct Market Access) | ❌ |

| ➡️ Futures Trading | ❌ |

| ➡️ Options Trading | ✔️ |

| ➡️ Investing Account | ❌ |

Spreadex Average Fees | |

| ➡️ FTSE 100 | 1 |

| ➡️ DAX 30 | 1 |

| ➡️ DJIA | 2.4 |

| ➡️ NASDAQ | 2 |

| ➡️S&P 500 | 0.6 |

| ➡️ EURUSD | 0.6 |

| ➡️ GBPUSD | 0.9 |

| ➡️ USDJPY | 0.9 |

| ➡️ Gold | 0.3 |

| ➡️ Crude Oil | 0.28 |

| ➡️ UK Stocks | 0.1% |

| ➡️ US Stocks | 0.15% (max $3.5) |

Spreadex Customer Reviews

Tell us what you think:

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex FAQs

Spreadex is a financial and sports bookmaker for UK clients and also offers contracts for difference for European traders (who are not eligible for capital gains tax breaks from financial spread betting).

For large amounts, you can request funds to be sent back to your account from Spreadex the same day. But, for smaller transactions, it can take between 1 hour and 3 days to receive funds. This depends on your bank, and how complete your AML documents are.

Spreadex offers financial spread betting which works by letting you place bets on the movement of financial markets. Instead of buying a certain amount of shares in a company, you bet an amount (either in pounds or pence) per point a share price moves.

Yes, Spreadex is a legit and safe trading platform as they are regulated by the FCA and are well established and well respected within the brokerage industry. Spreadex also ranks very highly in our awards for customer service and support.

64% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.