I know that’s a massive clickbait headline, but I couldn’t resist highlighting the somewhat sarcastic risk warning on ayondo’s website.

Whilst perusing through the client trading loss percentage report on Finance Magnates, I noticed that ayondo wasn’t featured. Which was a little odd, especially as eToro ranks as a broker that has one of the most profitable client bases. So off I trotted to ayondo’s website to take a look.

What I saw there was amazing…

(Ok, wow, I really have been browsing too much clickbait on taboola and outbrain)

It wasn’t that amazing, it was mildly drole, sarcastic and curled a jaunty grin as I imagined the compliance and marketing departments sticking two hidden fingers up at the regulators.

A little like that classic scene in Ali G – it’s on youtube if you fancy reminiscing…

I’ve always thought that adding a percentage of a particular broker’s client base that loses money to a risk warning is a little unfair.

Sure, if the broker advised in some capacity. But CFD and spread betting brokers are purely execution only, and have been for some time. In fact, they can’t even offer implied advice.

The percentage of winning or losing traders is based on all retail client accounts at a broker. This is regardless of size, experience, asset class traded, frequency if it’s hedging, portfolio protection or strategy testing.

This loss percentage is just based on what percentage of overall accounts over the last twelve months made or lost money.

It’s a well-known fact that most derivatives traders lose money. That’s just risk. But most are tyre kickers, dreams, gamblers and with the crypto trading boom bringing new traders to the game, inexperienced.

The regulators have done a good job in introducing negative balance protection for retail traders as well as capping excessive margin rates. But for financial promotions, balance has always been key.

With individual loss percentages, you feel that the scale has slightly tipped.

Anyway, ayondo has basically gone, yeah sure, most people lose money, but most only lose less than a hundred quid…

Ayondo’s risk warning reads:

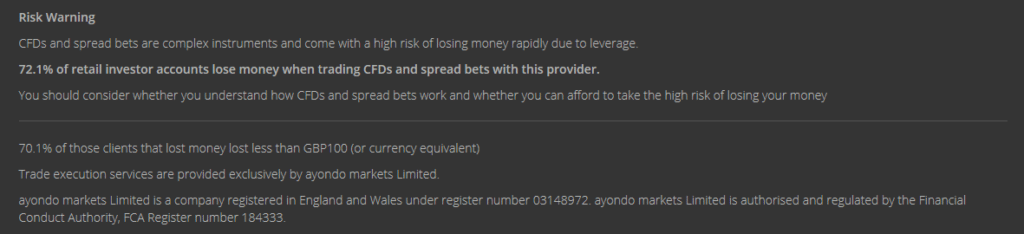

Risk Warning

CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage.

72.1% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

You should consider whether you understand how CFDs and spread bets work and whether you can afford to take the high risk of losing your money

70.1% of those clients that lost money lost less than GBP100 (or currency equivalent)

Made me chuckle anyway…

You can see the loss percentage particulars on the ESMA website here.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.