We have ranked, compared and reviewed some of the best professional trading accounts in the UK that offer experienced investors higher leverage, lower costs, and wider market access. Professional trading accounts offer higher leverage and lower margin on trading products such as CFDs or spread betting. Experienced clients can opt to upgrade from a retail classification to a professional by proving they have significant and or professional trading experience.

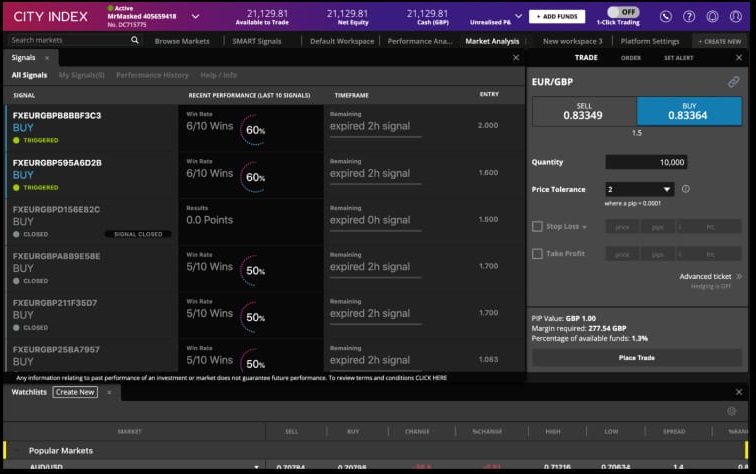

City Index: Best professional trading platform signals and analytics

- Markets available: 12,000

- Leverage: FX 250:1, Indices 250:1, Commodities 200:1, Shares 20:1, Crypto 30:1

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

69% of retail investor accounts lose money when trading CFDs with this provider

City Index professional account offers higher leverage, generous cash rebates across all asset classes and dedicated account management.

Pros:

- ✔️ Smart Signals

- ✔️ Performance analytics

- ✔️ Wide range of markets

Cons:

- ❌ No DMA

- ❌ No investing account

Pepperstone: Best professional MT4 trading platform

- Markets available: 1,200

- Leverage: FX 500:1, Indices 200:1, Commodities 200:1, Shares 20:1, Crypto 10:1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

75.3% of retail investor accounts lose money when trading CFDs with this provider

Access to higher leverage, exclusive account features and qualify join the Active Trader program where you’ll earn cash rebates for your trades. Plus get a dedicated relationship manager to look after all your trading needs and receive priority service.

Pros:

- ✔️ Good MT4 package

- ✔️ Discounted spreads

- ✔️ Stocks on MT4 & MT5

Cons:

- ❌ Third-party trading platforms

- ❌ Limited market range

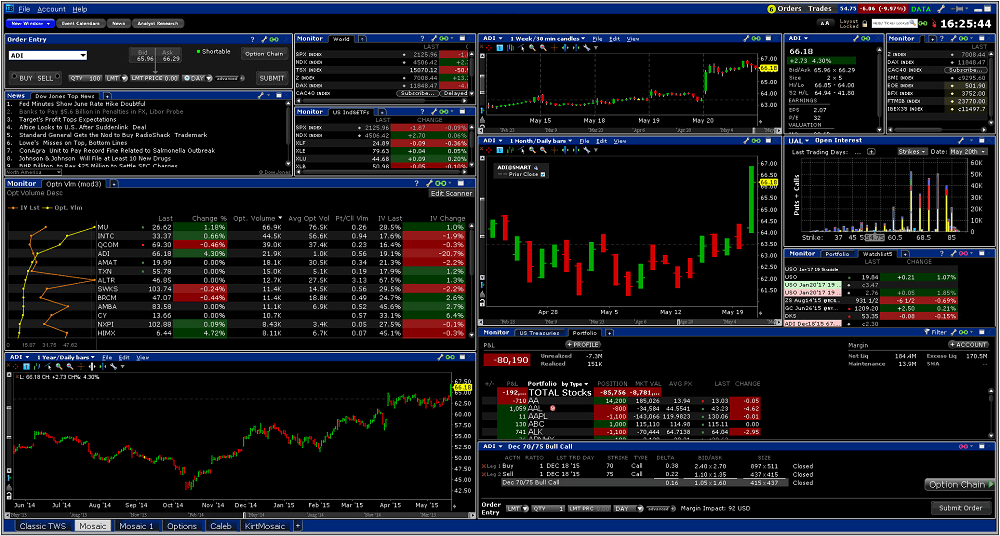

Interactive Brokers: Best professional trading account for sophisticated investors

- Markets available: 7,000

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Equity overnight financing: 1.5% +/- SONIA

- Pricing: Shares 0.02%, FTSE 0.005%, GBPUSD 0.0008%

60% of retail investor accounts lose money when trading CFDs with this provider

With IBKR’s Universal Account, clients can trade stocks, options, futures, currencies, bonds, and funds around the world from a single screen. Fund your account in multiple currencies and trade assets denominated in multiple currencies.

Pros:

- ✔️ Low cost

- ✔️ Wide market range

- ✔️Investment accounts

Cons:

- ❌ No financial spread betting

- ❌ No guaranteed stops

Spreadex: Best professional trading platform for customer service

- Markets available: 10,000

- Leverage: FX 222:1, Indices 222:1, Commodities 166:1, Shares 22:1, Crypto 5:1

- Account types: CFDs, spread betting

- Equity overnight financing: 3% +/- SONIA

- Pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

72% of retail investor accounts lose money when trading CFDs with this provider

Professional clients get better margin and leverage limits as they remain unchanged by the ESMA ruling for retail traders. You also get access to a dedicated execution desk and can trade with advanced platform features such as pattern recognition and Price Alerts. You may also be able to trade on credit.

Pros:

- ✔️Excellent customer service

- ✔️Smaller cap stock trading

- ✔️Wide market range

Cons:

- ❌Limited options trading

- ❌Trading only, no investing

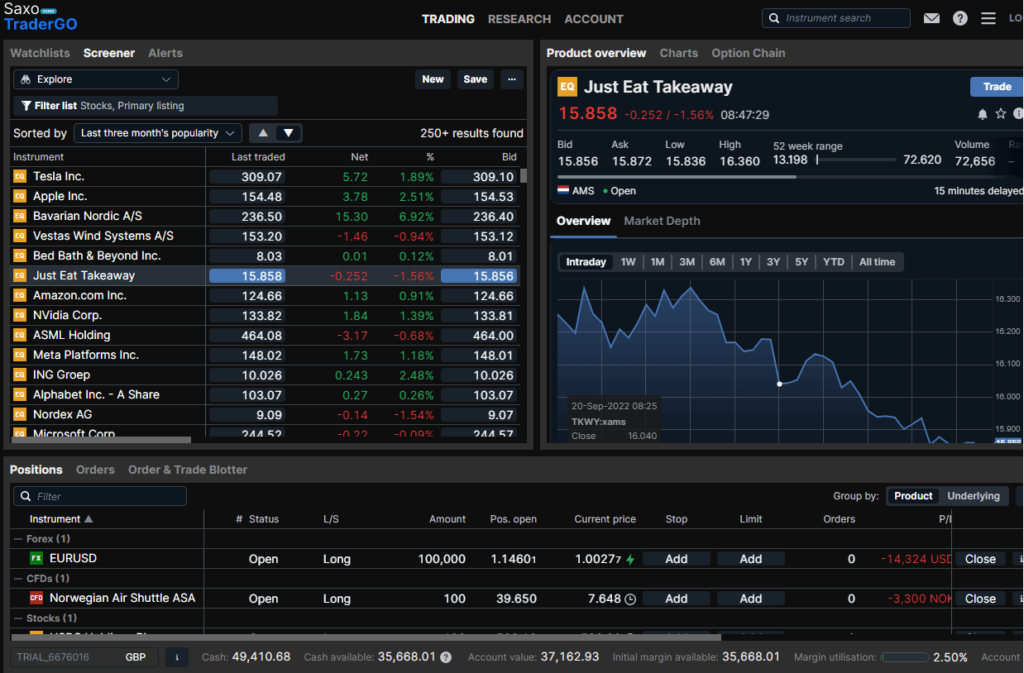

Saxo Markets: Best professional trading platform for DMA trading

- Markets available: 9,000

- Leverage: FX 66:1, Indices 40:1, Commodities 25:1, Shares 10:1, Crypto n/a

- Account types: CFDs, futures & options, DMA, investing

- Equity overnight financing: 2.5% +/- SAXO RATE

- Pricing: Shares 0.05%, FTSE 1, GBPUSD 0.7

70% of retail investor accounts lose money when trading CFDs with this provider

As a professional client margins are reduced to 1.5% forex, 2.5% for indices and 10% for equities. Plus, you can use a percentage of your shareholdings as

Saxo Markets won “best professional trading account” in our most recent 2023 awards. Saxo Markets provides a professional-grade trading platform backed up by experienced dealers with responsible leverage and a well-capitalised balance sheet. We have constantly ranked Saxo Markets as one of the best trading platforms for professional traders. Interactive Brokers and IG are also good choices for professional traders.

Pros:

- ✔️Professional trading platform

- ✔️Direct market access

- ✔️Futures & options

Cons:

- ❌High minimum deposit

- ❌Can be too complicated for beginners

CMC Markets: Best for segregated professional trading strategies

- Markets available: 12,000

- Leverage: FX 500:1, Indices 500:1, Commodities 200:1, Shares 33:1, Crypto 5:1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.9% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.59

74% of retail investor accounts lose money when trading CFDs with this provider

Pros:

- ✔️ Excellent platform

- ✔️ Client sentiment indicators

- ✔️ Tight pricing

Cons:

- ❌ No DMA

- ❌ No investment account

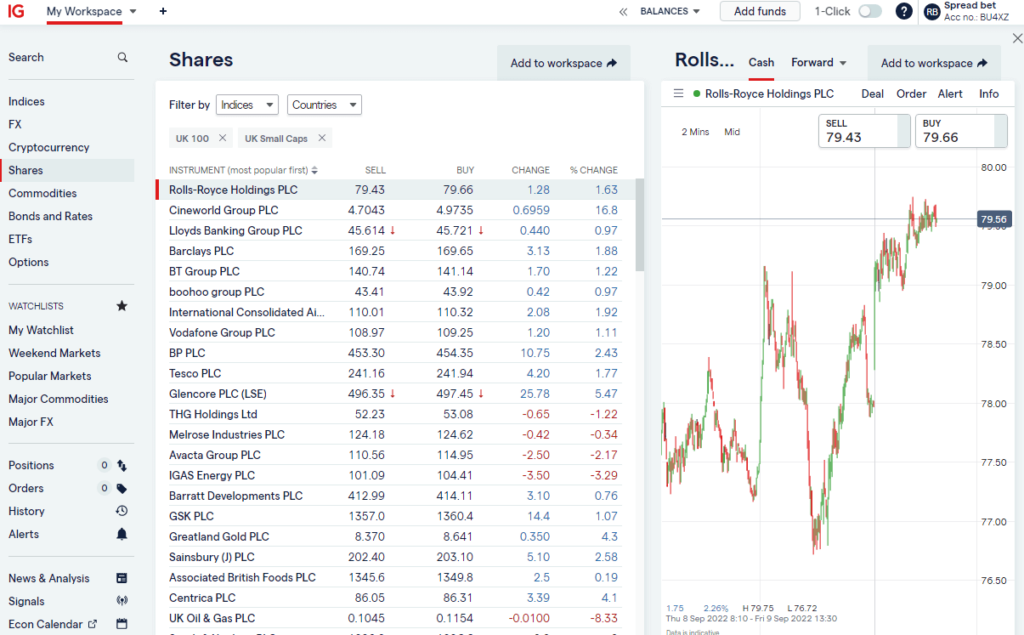

IG: Best professional trading platform for liquidity & market range

- Markets available: 17,000

- Leverage: FX 222:1, Indices 222:1, Commodities 158:1, Shares 11:1, Crypto 22:1

- Account types: CFDs, spread betting, DMA, investing

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.6

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Pros:

- ✔️Excellent market range

- ✔️Deep liquidity

- ✔️DMA & level-2 pricing

Cons:

- ❌Some pricing is not competitive

- ❌Very big so customer service can be a little slow

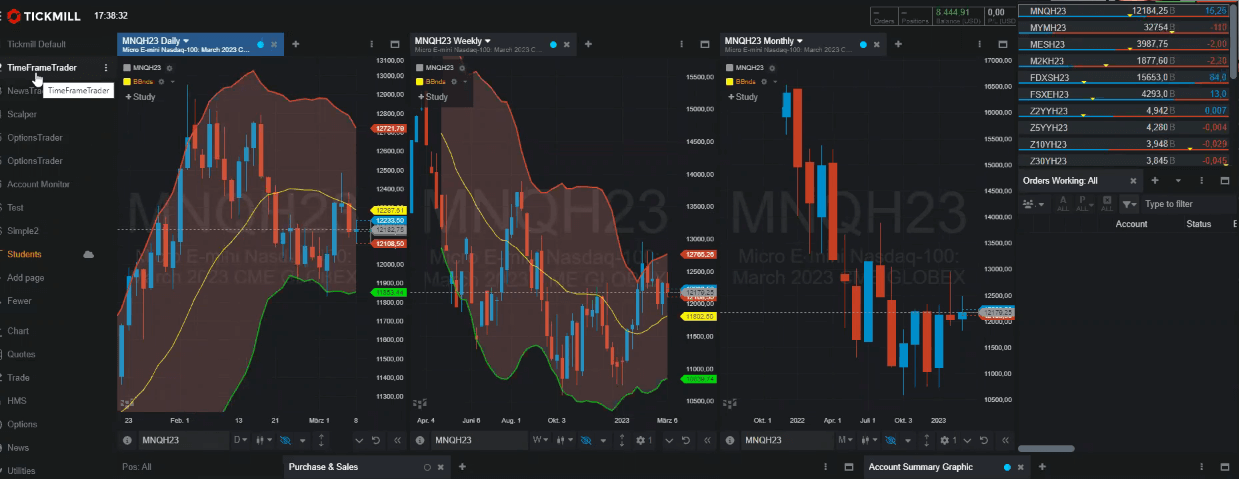

Tickmill: MT4 & CQG professional trading account

- Markets available: 578

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Pricing: US Shares 0, FTSE 0.9, GBPUSD 0.3

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill’s professional account gives you access to the most popular forex, index, commodity and US shares. For professionally qualified traders their commissions are some of the lowest around.

Pros:

- ✔️DMA trading

- ✔️Low cost

- ✔️Lots of platforms

Cons:

- ❌No UK shares

- ❌Only the most popular markets

❓Methodology: We have chosen what we think are the best professional trading account based on:

- over 17,000 votes in our annual awards

- our own experiences testing the pro trading accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the professional trading platform CEOs and senior management

Use our comparison table of professional trading accounts to see which broker offers the best margin and leverage on FX, indices, commodities, equities and cryptocurrency trading.

Compare Professional Trading Accounts

| Professional Trading Account | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 12,000 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 17,000 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 10,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 9,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 7,000 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 12,000 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 2,976 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 578 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 5,000 | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 2,100 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider |

Account Types

You can see which professional trading accounts have advanced features here.

| Advanced Features: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Algo Trading | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Prime Brokerage | ❌ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

Market Access

| Account Types: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Spread Betting | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| DMA | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Investments | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Futures & Options | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

Margin & Leverage

You can compare margin rates for professional trading accounts in this comparison table.

Industry experts told us

"UK regulation is there to protect retail traders from overleverage and risk, but for more advanced and sophisticated traders, it is possible to get access to institutional margin rates and service from brokers with a professional trading account."Professional Trading Accounts Explained

In this guide, we will go through what professional accounts are, the pros and cons and also who they are appropriate for.

As trading has become more accessible to private clients the regulators (FCA & ESMA) have restricted how much leverage a retail client can have and also what products they can trade. However, if you are an experienced trader and still want to trade off reduced margin rates and want access to risker derivatives products like crypto, you can opt to upgrade your account to an elective professional.

It’s important to note that not everyone can elect to become a professional client. Only those clients with sufficient trading experience and understanding of the product can do so, both of which are validated by a quantitative and qualitative test by the broker.

Whilst it may look attractive as traders get to keep the previous levels of leverage, upgrading your classification comes with some hidden dangers that you should be aware of. It’s a broker’s responsibility to ensure you are fully informed of the protections you lose by upgrading.

Professional clients are deemed capable of making their own investment decisions. Criteria may change a little from platform to platform, but generally speaking you will need to have been working in a professional position in financial services for at least a year, have a portfolio of at least €500 and you must have a certain level of professional trading experience.

The difference between professional and retail status

The key differences between brokers offering professional trading accounts are:

- Margin rates

- Commission rates

- Spread width

- Additional/restricted market access

- Voice brokerage/personal account managers

- Commission reductions for professional trading accounts

What you typically lose as a professional trader

- Negative Balance Protection

- Funds not Segregated

- Margin Closeout at 50%

- Ability to use Financial Ombudsman Service

- Standardised risk warnings

Some professional trading accounts also offer rebates for higher-volume trading. Or may even offer a reduction in trading commissions for high volume accounts

They may also differ in the amount of support they offer and the accessibility of their service. Because you’re classified as a professional investor, many firms may assume a certain level of knowledge on your part. This means the language may be more complicated and they may offer little in the way of tuition, or expert support.

Benefits of professional accounts

There are benefits to becoming a professional trader. These benefits can include;

- a reduction in margin rates

- using collateral as margin

- rebate on high trading volumes

You’ll be treated as someone who knows what they are doing and understands the risks they are taking on.

Dealer access

You’ll be given a dedicated client account manager and access to the latest and most sophisticated trading software. Most will also offer reductions on margin rates. Most importantly you’ll get better margin rates when trading CFDs or spread betting in a professional account.

Lower trading costs

The other main benefit is that your trading costs are lowered the more you trade. For high volume traders broker will offer a rebate on trading fees, which is essentially reducing your commission, if you put the volume through.

Collateral as margin

As a professional trader, you can use your longer-term investments as collateral for derivatives trading. This is generally restricted to professionals as it is not usually advisable using lower and medium-risk investments to cover the margin on short-term high-risk trading. There are circumstances when it is suitable, which we cover in our guide on using investments as collateral.

Better margin rates

Retail margin rates are capped by the FCA and one of the major benefits of a professional trading account is that you get increased leverage and reduced margins. This increases the amount of exposure you can have to the market, but it also increases the risk, and with it how much you could potentially lose.

Risks of professional accounts

As result a professional client, you’ll waive some of the FCA protections given to retail clients including:

- no negative protection

- no leverage or product restrictions

- reduced client money segregation rules

- assumption of increased experience by the brokers so they won’t explain things in detail

No negative balance protection

Negative balance protection does not apply, so if your losses exceed your balance you could be in trouble.

With leveraged trading, it’s a significant risk that you could lose more than the funds you hold in your account. This is because you are essentially trading larger positions than your invested funds could normally afford. One of the key motivations behind installing Negative Balance Protection for retail traders is that it affords them greater protection against sharp market moves that are amplified by leverage. So it provides peace of mind to know that even though you deposited for example £2,000 in your trading account, you cannot lose more than that amount and end up owing the broker money.

No client money segregation

Additionally, retail clients have the ultimate protection in that firms are required by the FCA to fully segregate all retail Client Money in a trust account and not mix this with their own funds. The protection being that in the event a broker goes into liquidation, all retail Client Money is still safe and secure for the administrators to return back to clients. However, many brokers won’t segregate the funds of Elected Professionals clients, meaning that if a broker goes bust, Elected Professional client funds are at significant risk.

Assumption of experience

If you become an elective professional trader your broker will assume you understand the risks, terminology and markets and will therefore be under less of an obligation to explain them to you.

⚠️ FCA Regulation

All brokers that offer professional trading accounts that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK brokers are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature professional trading accounts that are regulated by the FCA, where your funds are protected by the FSCS.

Professional Trading Account FAQ:

You should only upgrade to a professional trading account if you have the relevant experience and fully understand the risks involved. First of all, professional CFD and spread betting accounts are not for everyone. I’ve been involved in spread betting and CFDs for about twenty years, but of late there has been a real move to make CFDs and spread betting mass-market products. However, they are not.

There are about 150,000 active traders in the UK, about 340,000 in EMEA and only about 100,000 in the US. Which is not really a lot, when you think about the size of the overall investing markets.

No matter how many brokers sponsor football teams, or how many flash little gits you see on Instagram bragging about their Forex profits, derivatives are not for the masses.

Trading spread betting (compare spread betting brokers here) and CFDs (compare CFD brokers here) is very risky and as per the new ESMA required risk warnings around 75% of traders lose money. But who knows what that is based on, or how accurate the reporting is, or even if it’s even relevant.

But never the less, traders will trade and they will want to make the most efficient use of their risk capital by searching for a broker that offers the best margins, rates and access.

If you qualify for a professional trading account they are a safer option than going offshore with an ASIC-regulated broker.

Traders must be able to answer ‘yes’ to two or more of the below criteria to be considered for classification as a professional trader:

- Has your trading averaged 10 significantly sized leverage transactions per quarter over the last 4 quarters?

- Do you have a financial instrument portfolio, including cash deposits, exceeding €500,000?

- Have you worked in the financial sector in a professional position, requiring knowledge of derivatives trading, for at least a year?

The easiest way to become a professional trader is to get an official trading qualification and trade for an institutional capital markets company.

To trade the markets like a professional, you will need experience, risk capital and treat trading as your primary income source.

Professional traders will either use an inhouse developed trading platform from professional futures brokers like Interactive Brokers or Saxo Markets, or a futures trading platform like TT (Trading Technologies)

Professional forex traders will trade DMA forex, forex CFDs, forex futures and forex options through a futures broker

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the professional trading platforms via a non-affiliate link, you can view their pro account pages directly here: