If you are looking for an online trading platform that offers guaranteed stop losses, we’ve put together a handy little guide on what guaranteed stop losses are, their advantages and disadvantages and also which brokers offer them.

What is a guaranteed stop?

Guaranteed stop losses are stops are like normal stop losses but differ in that the price you set is guaranteed with no slippage or partial fills. They are a very effective way to manage risk when trading CFDs or spread betting, although they do cost a little more to execute.

Guaranteed stop losses versus normal stop losses

There are a few different types of stop losses in financial trading

- Market stop loss – this is triggered as a market order when your stop price is triggered. The advantage of this is that you will always be filled. The disadvantage is that if the market is thin or volatile slippage means it could be far from your stop price.

- Limit stop loss – this is triggered as a limit order when your stop price is hit. The advantage is that your position will only be filled at your stop price or better. The disadvantage is that if the market gaps below your stop price it won’t get filled (if it’s a sell stop).

- Stop loss to open – this is when you set an order to open a position when your stop price is hit rather than close one. The advantage is that you can open a position if the market starts moving the way you want it to.

Is there a guaranteed stop loss cost or premium?

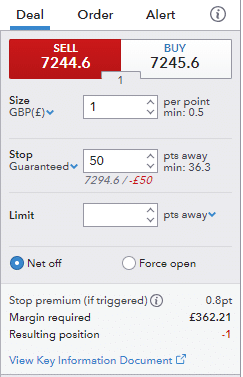

Yes most of the time – this will be in the form of a widened spread. Most brokers charge slightly different amounts but it will be shown on the trade ticket when you enter the order. For example, IG guaranteed stop losses come with a 0.8 a point premium for the FTSE 100 (see image).

Brokers that offer guaranteed stop losses:

The below brokers offer trading platforms with guaranteed stop losses and are regulated by the FCA.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.