To invest in emerging markets you need a stock broker that offers international investing like Hargreaves Lansdown, or a derivatives platform that offers exotic indices like Saxo Markets.

Once in a while, emerging markets (EM) are a ‘must have’ for investors. Remember the eagerness of fund managers towards China back in 2010? Investors flocked to them because they expected high growth and good asset returns. This guide shows you how you should invest in emerging markets, particularly the optimal time to buy and common traps to avoid.

What Are Emerging Markets?

Here are seven things you should know about the emerging markets before you invest.

- Emerging Markets (EM) is a generic term that includes a diverse array of developing markets. Because of this broadness, many analysts have grouped EMs into distinct collections, of which the most famous is BRICS (Brazil, Russia, India, China, South Africa) – a term coined by Goldman Sachs back in 2001. This group continues to meet regularly, with the latest 15th summit in South Africa (2023).

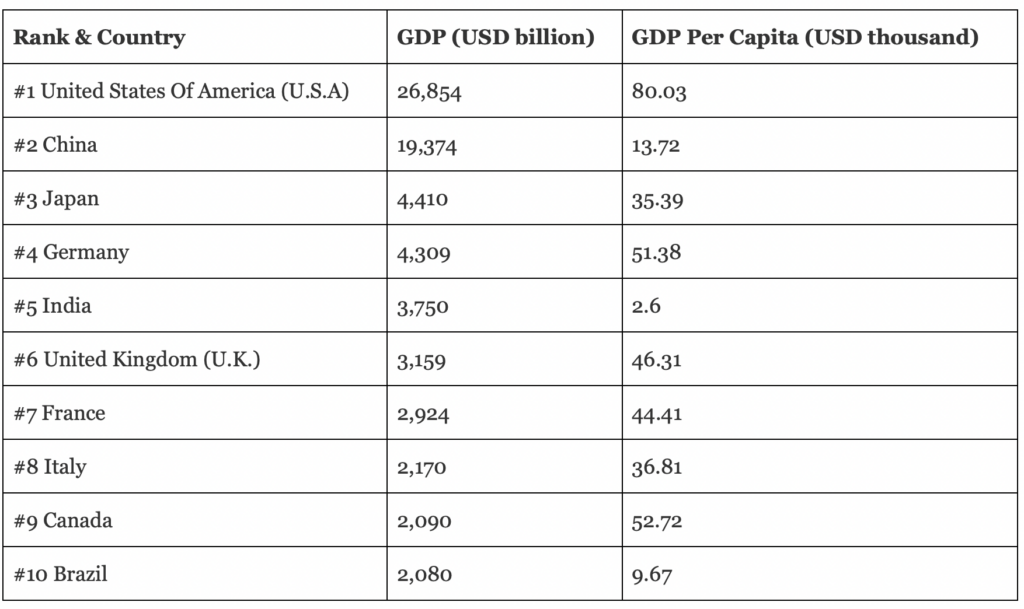

- Within the emerging markets sphere, the largest economies are China and India. In fact, these developing economies are larger than most developed nations. According to the latest IMF data, three of the ten largest economies are developing countries. For example, China’s GDP now is about 5x larger than that of France’s; while India’s GDP has powered ahead of the UK (see below). Source: IMF 2023

- Many emerging market economies have enacted capital or FX control regimes. For instance, China runs a ‘closed’ capital account policy. When investing in EMs you have to find out if you can move your capital freely. If not, during a recession your capital could be trapped there.

- Emerging economies can move into ‘Developed’ status after decades of high economic growth. South Korea is a good example. In 1950, South Korea’s GDP per capita ranked below that of Kenya. Now, Korea’s per capita GDP is 14x larger. In 2021, UNCTAD formally recognised Korea as a developed nation. In other words, EMs evolve over time.

- Emerging market stock markets are cyclical and highly volatile. This is because EMs experience strong upswings on the way up and severe corrections on the way down. Inflation is a particularly pernicious factor that amplifies EMs’ boom-bust economic cycle. In 2022, Turkey was at one point hit by an annualised inflation rate of 85%.

- The population of emerging countries form a major part of the global human race. According to one fund manager: “EMs account for 82% of the world’s population.” Therefore, emerging economies are predicted to grow faster than developed countries due to their favourable demographics.

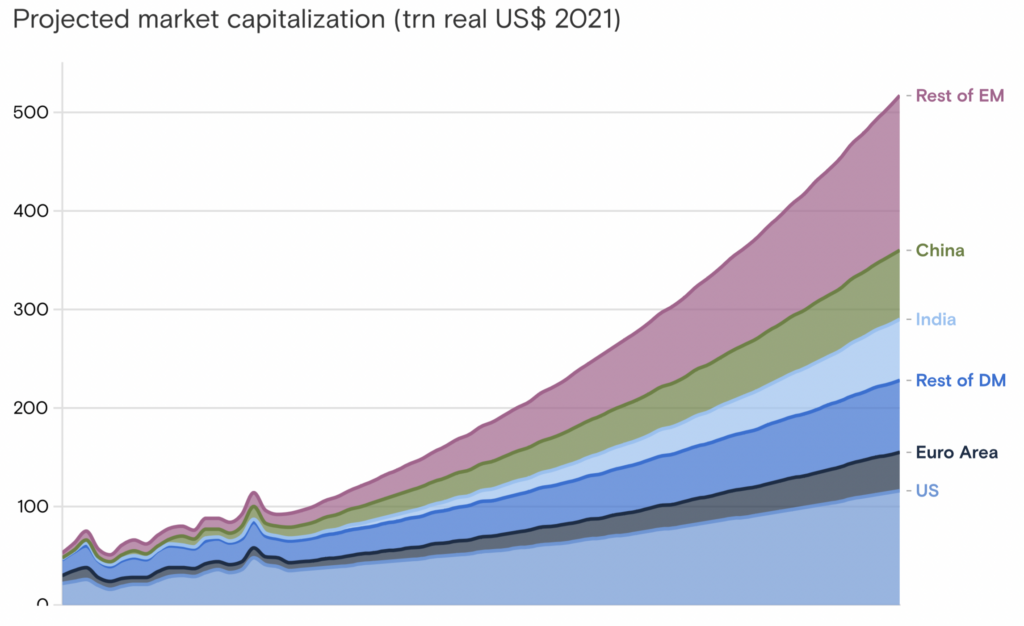

- The overall emerging markets market capitalisation is smaller than some developed markets. This means that EM’s market capitalisation is expected to grow at a faster rate. For example, Goldman Sachs predicts that in fifty years the Rest of EM, excluding China/India, would surpass that of the DM (see below). Of course, in reality markets don’t grow in a straight line like that.

Source: Goldman Sachs (2023)

When To Invest In Emerging Markets

Emerging markets are highly cyclical.

Very often, you will see a massive economic boom followed by a sharp crash. Few EMs can escape from this natural economic sequence since monetary excess accumulates during an upswing. The bust then erases over-leveraged economic entities and wipes out unsound macro policies. This prepares the ground for another upswing.

Based on these observations, there are two windows of opportunity to invest heavily in emerging markets:

- When growth is about to take off (albeit from a low base)

- During a severe economic crisis

The first window is based on the fact that the EM is about to be recognised as a good place to invest. Major capital players pile in. Asset prices lifted quickly.

Historical examples of this included: 1970 Japan, 1980 Singapore/HK, 2000 China, et cetera. Once you have invested, wait for a few years before exiting since the upswing can last for years.

The second window is simply bargain hunting. A crisis equals opportunity. When a market collapses into near-oblivion, there are surely bargains to be acquired.

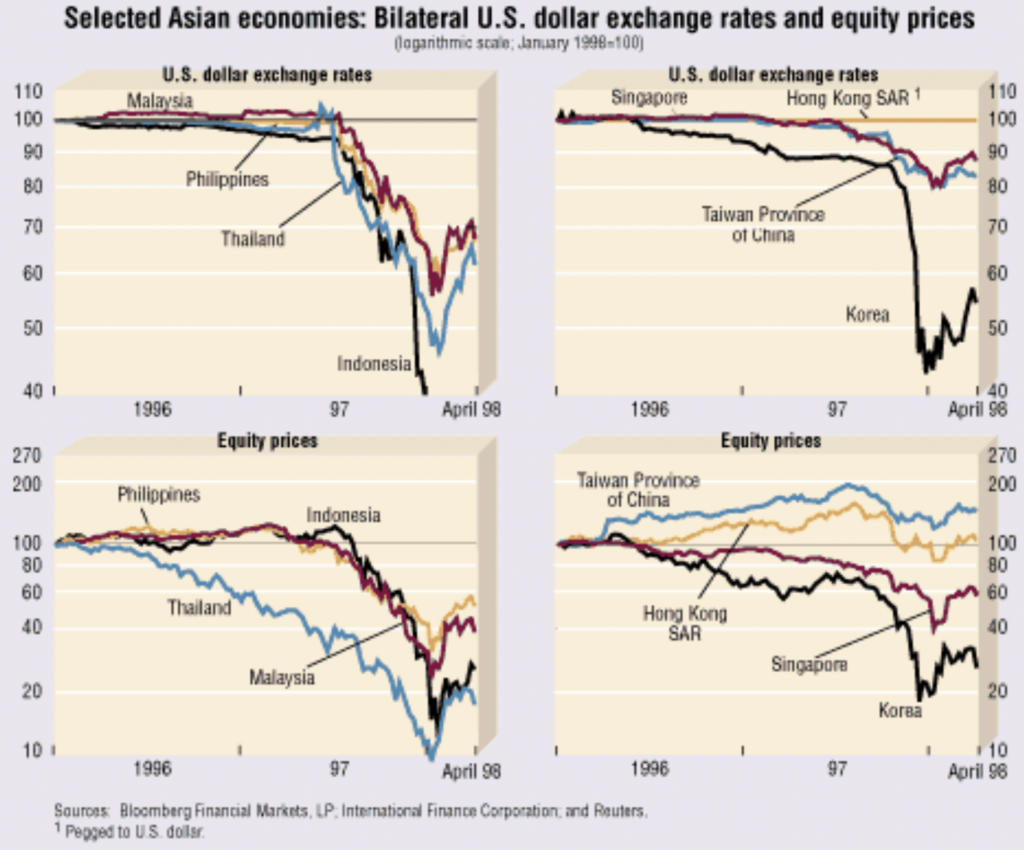

Did you know this: During the 1998 Asia Financial Crisis the Korean KOSPI Index collapsed by 80% (USD terms)? You could buy the entire market for a song. Those who did buy excellent Korean companies at bargain basement prices made a fortune.

Therefore, the next time you see a major market crisis in some EMs, take a look if it is worth taking a risk.

Source: IMF (1998)

Choosing An Emerging Market To Invest In

Which EMs do we invest in? More importantly, how do we choose them?

At the moment, there are about 195 independent countries globally, give or take. Within this group, around 150+ are developing. This suggests that 3/4 of all nations have yet to reach ‘developed status’.

Where should we invest among these 150+ developing nations? The main criteria to filter undesirable markets is governance.

A nation must have the following to attract foreign capital over the long term:

- a stable government

- a suitable environment for commerce, ie ‘open for business’

- good infrastructure (especially transport network and labour)

Capital flows to places where it is most well treated.

Many countries have, over the past decade, experienced wars, revolutions or significant political upheaval. Do you think businesses will move there? No!

From the perspective of large businesses, stability is the most important criteria because a $1 billion investment will require many years of payback. They can not afford to invest in a place where there is warlordism, shifting regulations and an undeveloped financial system.

In applying the above criteria, this will narrow the potential investable EM universe to about 25+ emerging markets.

In Asia, you will be looking at China, India, Vietnam, Malaysia, Thailand, or Philippines.

In the Americas, the four EMs stand out – Chile, Mexico, Brazil, Argentina.

Meanwhile, in the Middle East/Africa, Turkey, Saudi Arabia, UAE, Qatar, South Africa. And in Europe, perhaps Hungary, Romania, Poland, Czech (former Soviet states).

Of course, which market to invest in depends on your ‘edge’. Ask yourself these questions:

- Do you know anything about that region?

- What do you know about that particular emerging market?

- Have you travelled there before?

Learn about the region as much as you can before investing in it.

Emerging Market Asset Classes

Timing aside, what should we be investing in Emerging Markets?

This depends on a few factors. The first one is: What is the niche of that particular emerging economy?

Take Indonesia, the world’s fourth most populous country (277 million). Its economy differs sharply from say, Pakistan or Nigeria. Indonesia has a large population. So its leading consumer companies are huge. The country exports a lot of commodities; hence you will expect a few commodity groups.

Favourite sectors when investing in EM are:

- Property, construction and materials

- Banks and other financial institutions

- Consumer groups

- Conglomerates

- Utilities

Many commodity EMs have large commodity miners – meaning that during a commodity upswing, these companies will benefit disproportionately. Countries like Chile (lithium or copper) or Saudi Arabia (oil).

When the Chinese economy took off in 2000, you invest in the country’s property, financial and materials companies. Later, the government forced these industries to upgrade. So you rotate into technology companies like Alibaba (BABA) or car manufacturers like Li Auto (LI).

In other words, when investing in EMs there is no standing still.

Very often, sectors will come and go. A prosperous industry may suddenly break down suddenly due to policy changes. You will need to keep up with the EMs that you are investing in so as to follow their development paths. Nothing is predetermined.

If you are unable to research all this information yourself, perhaps buying an exchange-traded fund (ETF) is more suitable since it will help to diversify among a large number of stocks that you can carry.

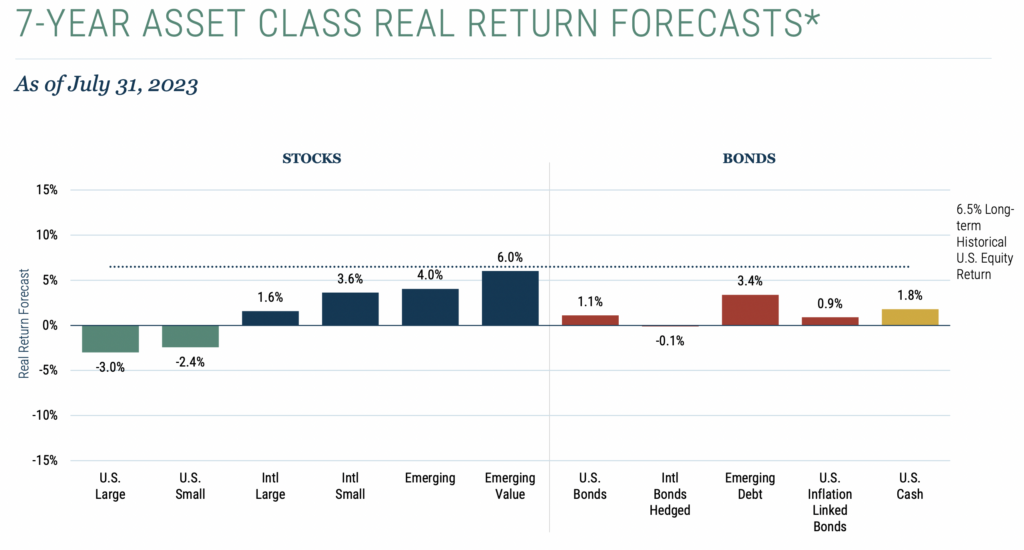

Interestingly, according to the multi-billion GMO fund manager, EM equities are predicted to do well over the next few years – surpassing that of the US stocks (large and small). In fact, they expect EM value stocks to outperform most other asset classes too.

Source: GMO (2023)

Risks Of Emerging Markets Investing

Every investment instrument carry risks. Price risk, default risk, or simply timing risk.

When investing in EMs, there are a few risks that you, as a foreign investor, must take into account:

- Price risk – that the stock price will drop steeply after purchase, thus incurring deep drawdowns

- Default risk – that the company will default on its dividends or bond coupons due to operational losses

- Political risk – a shock election often send the local stock market into a tailspin

- Nationalisation risk – a government can nationalise a company if they deem it necessary

- Foreign Exchange risk – that the currency of a developing nation will fall sharply

Normally, you would think that price risk dominates. Not necessarily. Sometimes the FX risk is even more pronounced.

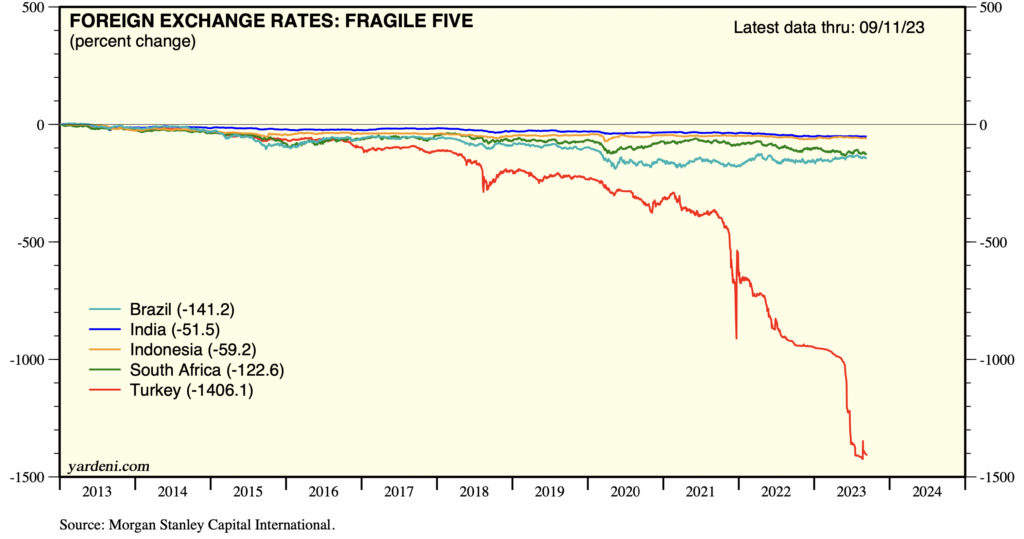

Take a quick glance at the exchange rate of the so-called “Fragile Five” – a group of EMs with very weak currencies (coined in 2013). They are Brazil, India, Indonesia, South Africa and Turkey. The worst of the lot by far is Turkey. Six years ago, 3.5 Lira = 1 USD. Now it takes 27 Lira.

In sum, the exchange rate risk is real and may erode any potential returns from investing in EM assets.

Source: Yardeni.com

Emerging Market ETFs (US-Listed)

ETFs are one of the best instruments to gain exposure to a particular sector, country or a niche industry in a passive manner.

There are many dedicated EM-related ETFs in the US. The top three EM ETFs by assets are (all in excess of $20 billion):

- Vanguard FTSE Emerging Markets ETF (VWO)

- iShares Core MSCI Emerging Markets ETF (IEMG)

- iShares MSCI Emerging Markets ETF (EEM)

The long-term chart of VWO is below (fairly flat, but with occasional rallies):

Regional ETFs can be too broad for some. A more concentrated bet on certain countries (like India) may be preferred. Hence there is a demand for single-country ETFs.

A partial list of Single-Country ETFs include:

- China – iShares China Large Cap (FXI)

- India – iShares MSCI India (INDA)

- Indonesia – iShares MSCI Indonesia (EIDO)

- Malaysia – iShares MSCI Malaysia (EWM)

- Vietnam – VanEck Vietnam (VNM)

- Turkey – iShares MSCI Turkey (TUR)

- Brazil – iShares MSCI Brazil (EWZ)

- Mexico – iShares MSCI Mexico (EWW)

- Chile – iShares MSCI Chile (ECH)

- Argentina – iShares MSCI Argentina (ARGT)

- South Africa – iShares MSCI South Africa (EZA)

- Nigeria – Global X Nigeria (NGE)

- Poland – iShares MSCI Poland (EPOL)

The chart of China’s large-cap ETF (FXI) shows a market in decline. Prices are near its lower side of the long-term range.

For more risk-seeking investors, there is this Frontier Market ETF (FM). (When a country is less developed than an emerging nation, it is known as a ‘Frontier Market‘.)

Conclusion: Should You Invest In Emerging Markets?

Emerging markets are a big draw for many investors because these markets move differently to developed economies. EMs provide diversification for portfolio managers and big returns too if you get the timing right. Emerging economies have high growth because of rapid urbanisation, robust infrastructure building and the expanding middle class.

However EM is not for everyone. They carry significant risk for new investors because of their price volatility. Many EMs’ currencies exhibit huge moves that erode potential asset returns.

When in doubt, stay away. Only invest when you feel the risk-reward ratio is good enough.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.