Volatility trading platforms let you trade through synthetic indices like the VIX, VXX, VXZ and volatility 75 index. You can use our comparison table of what we think are the best synthetic indices brokers to compare trading costs, minimum deposits and how much it costs to keep positions open overnight. All brokers in this list are regulated by the FCA.

City Index: Best Volatility CFD trading platform

- Costs & spreads: 0.15

- Minimum deposit: £100

- Account types: CFDs & spread betting

69% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: Automated VXX trading on MT4

- Costs & spreads: 0.2

- Minimum deposit: £1

- Account types: CFDs & spread betting

75.3% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: Volatility trading with personal service

- Costs & spreads: 0.25

- Minimum deposit: £1

- Account types: CFDs & spread betting

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Discount VIX trading

- Costs & spreads: 0.005%

- Minimum deposit: $2,000

- Account types: CFDs, DMA, futures & options

60% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets: High-tech Volatility trading platform

- Costs & spreads: 0.13

- Minimum deposit: £1

- Account types: CFDs & spread betting

74% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets: Best Volatility futures trading & ETF platform

- Costs & spreads: 0.15

- Minimum deposit: £500

- Account types: CFDs, futures & options

70% of retail investor accounts lose money when trading CFDs with this provider

eToro: Copy other people’s Volatility trading

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Tickmill: Volatility futures on CQG or CFDs on MT4

- Minimum deposit: $100

- Overnight financing: na

- Account types: CFDs, futures & options

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

❓Methodology: We have chosen what we think are the best volatility and synthetic index trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the synthetic indices trading accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative volatility brokers.

- interviews with the volatility trading platform CEOs and senior management

Compare Volatility & Synthetic Indices Brokers

| Synthetic Index Broker | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|

| £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| $100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| £100 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| $2,000 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

Trading VIX futures:

VIX futures were created around 2004 to facilitate trading and hedging of volatility and are based on the VIX index. The VIX index is based on the options on the S&P 500 Index (SPX), the most-watched US equity index. SPX is a broad measure of the US stock market which tracks the top 500 listed US companies.

You can not trade the VIX index directly nor can you trade volatility directly like you trade stocks. To do that, you need derivatives – like futures and options, spread betting or CFD trading.

Trading VXX & VXZ ETNs

VXX and VXZ (its sister fund) were the first ETNs (Exchange Traded Notes) made available for volatility trading in the United States. To properly understand what VXX is, you need to understand how its value is assessed, and how Barclays (Britain’s foremost multinational banking and financial services company) earns equity from running it, and what it actually tracks.

In 2009, Barclays created two of the earliest volatility ETNs – VXX and VXZ (its sister fund). These ETNs were made available for volatility trading in the United States just like any other stocks (prospective here).* They can be sold, bought, or sold short whenever the market is open for trading, and that includes both pre-market and after-market timeframes. The current market cap of VXX is around $800 million. The average daily volume consists of 40 million shares, and its liquidity and spread status is very good. The bid–ask spreads are just a penny.

For example, the chart below shows the typical spread from IG index. In other words, moving in and out of volatility products are not overly expensive here in the UK.

To trade volatility ETNs successfully, however, you need to remember two things:

- Volatility ETNs are not meant for long-term holdings

- Volatility ETNs are high risk and prices can swing wildly over a short period of time

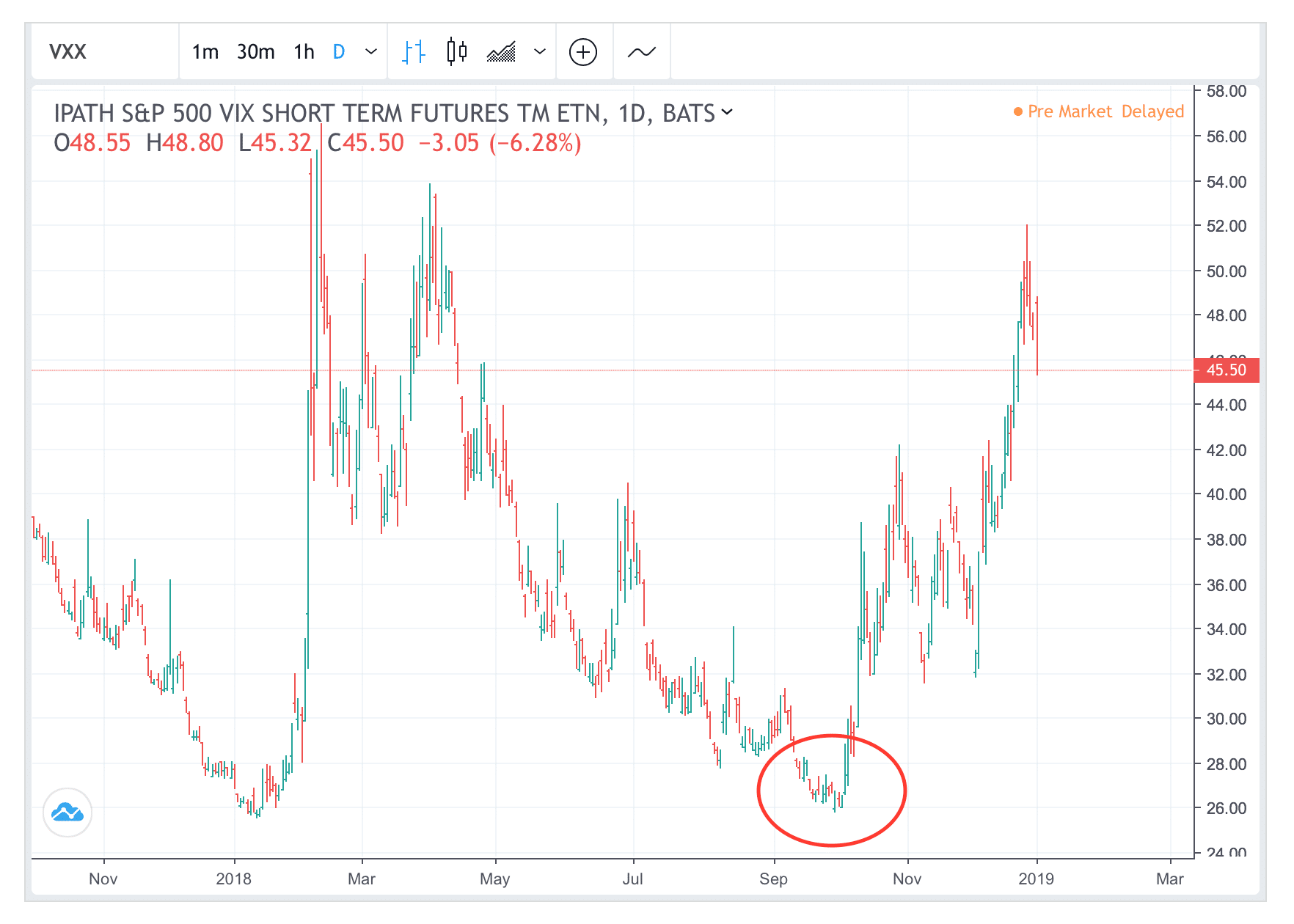

You can judge this from the price movements of VXX in 2018. Throughout the year, prices went from $28 to $50 twice. Daily 5-10% moves occur regularly; overnight price gaps further amplify this swings. So, how exactly do you use VXX to hedge against your long-only portfolio?

The general rule of thumb is to buy a small amount when the product is down for some time. Why? This is because markets tend to go up slowly and go down quickly, especially as we are on a bull cycle.

For example, VXX can roll lower continuously for six months and then, all of a sudden, surge. This price behaviour is typical (red circle, below). Accordingly, when VXX is down, buy some and hold for a few weeks before selling out. Of course, you may very well sell at a loss, but try to think of this as as the cost of protection for your share portfolio. The trick is to time your entry because VXX can move very fast.

Other entry signals for VXX include: 1) A bullish crossover of VXX against some medium-term moving average such as the 50 or 100-day moving average, or 2) Corrective setbacks after hitting multi-week highs, ie, around $32.

In all these cases, the advice is to limit the holding period because volatility ETNs can depreciate over time. Of course, having stop-losses on these positions are critical. Also, if you had timed VXX’s rally correctly, use trailing stops to protect your profits.

*http://www.ipathetn.com/US/

Typically speaking, VXX trades like any other stock. As such, it can be sold, bought, or sold short whenever the market is open for trading, and that includes both pre-market and after-market timeframes. The average daily volume consists of 75 million shares, and its liquidity and spread status is very good; the bid–ask spreads are just a penny. Here are a few of the best brokers for trading VXX Volatility

Best VIX, VXX & VXZ synthetic indices trading CFD & spread betting platforms

The major trading platforms that offer CFD trading, financial spread betting, futures and options on volatility markers are:

- IG – best for volatility spread betting

- Saxo Markets – best for volatility futures

- CMC Markets – best for volatility CFDs

- Interactive Brokers – best for volatility options

With this in mind, brokers that typically have tight spreads don’t have the same issue with trading VXX. spread betting broker IG Index, for example, has a relatively high average spread of on ETNs such as VXX and VXZ however, they do offer one of the widest-ranges of accessible markets and are listed on the LSE.

Similarly, forex broker CMC Markets, while having a good average spread already, has an extra sweetener for large-scale investors. It has a “big trader rebate scheme” with its own modern trading platform. If you’re after a long-term growth strategy with a large amount of capital, trading VXX with CMC Markets could be a wise move.

CFD broker Saxo offers VIX CFDs as well as DMA VIX on-exchange futures contracts. MT4 broker XTB offers the ability to create your own basket of assets to trade so you can trade volatility indices against other assets like Gold and USDJPY.

Whichever of the best brokers for trading VXX Volatility or CFD trading platforms you decide to go with, ensure that you do thorough research to mitigate risk and maximise your potential return on investment.

⚠️ FCA Regulation

All synthetic index trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK volatility brokers are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature volatility trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.

Volatility trading FAQs:

When asked what he thought of the stock market, JP Morgan quipped: ‘It will fluctuate’. Indeed. Markets go up and down – and when prices are down, investor fear increases and volatility spikes. This is simply because of higher market uncertainty. Given volatility’s inverse behaviour to prices, volatility indices are usually known as the ‘fear gauges’.

Yes, Volatility ETFs, such as ProShares VIX Short-Term Futures ETF and ProShares Ultra VIX Short-Term Futures ETF can be bought through a stockbroker and is as easy as buying any other stock like Apple or Lloyds.

Synthetic indices are stock market indices based on several contributing markets.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the volatility brokers via a non-affiliate link, you can view their volatility trading pages directly here: