Scalping is a type of forex trading strategy where you deal in and out of positions quickly to make small high-frequency profits. In the twenty years I’ve been a forex broker, trader, analyst and pontificator, I have seen many traders fail to follow the basic trading strategy of run your wins and cut your losses. But there is one type of trading where that rule does not apply. Scalping, which is all about taking profits quickly.

How to quickly take profit when scalping in forex

If you want to take quick profits when scalping, make sure you follow these principles:

- Use a broker that provides DMA or STP trading

- Add stops and limits when you place your entry order

- Use an algo execution ticket to automate larger orders

- Trade liquid markets where there is constant volume on the order book

- Avoid trading around economic indicators (I have seen many trading strategies wiped out over non-farms)

- Always trade within your limits and risk appetite

Which brokers offer scalping?

If you’re looking to scalping, we’ve compiled a list of the best brokers for trading via scalping. All brokers in this list are authorised and regulated by the FCA. Ensure that you are using the best platforms for trading indices and choose a brokers from our comparison list of the best brokers for scalp trading.

In a nutshell, the best brokers for scalping offer DMA such as:

Which brokers are good for scalping and why does it have a bad reputation?

Firstly, let’s address why brokers don’t like client scalping.

When CFD brokers process orders some are hedged and some are internalised and matched with other client orders.

This isn’t because (as some suggest) it’s all a massive conspiracy where the broker wants their clients to lose money like a bookie.

It is infact based on efficiency.

If a client is trading the FTSE at £10 per point that can be hedged directly on the exchange as a FTSE future is £10 per tick move for one lot.

However, if a client is trading £1 a point the broker can’t hedge it unless it takes on some risk and waits for other clients to fill up their FTSE order book.

I’ve worked at all sorts of brokers over the years and the one thing they want above all others is long-term relationships with their clients. It costs a broker a fortune in marketing to onboard a new customer so they want them to have an account for a long time.

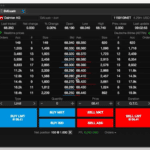

So, if you have a big enough account and have an effective trading strategy then you need a broker that offers DMA on exchange like Saxo. This way you can work your orders inside the bid/offer spread and get a better execution than via a broker providing OTC quotes.

You can compare DMA brokers here.

An example of scalping in the Forex market would be:

A trader places a buy order when the EURUSD is at 1.1294, they also place a sell order at 1.1295. If they are spread betting on forex and the stake size is £100 per point they stand to make a quick £100 if the sell order is filled on short-term volatility.

Scalpers make profits on FX by doing this several or hundreds of times a day. It’s a pretty high-risk form of trading and requires a serious amount of leverage and risk. If a position moves against you it can start to create a large loss in a short amount of time relative to the potential profits from the limit order.

Why do some Forex brokers ban scalping?

This depends firstly on what type of Forex broker you use. There are two types of brokers:

- Forex brokers that hedge your positions

- And brokers that don’t

Read more on STP/ECN brokers here

Just because a broker doesn’t hedge client positions all the time doesn’t necessarily mean they are evil. After all, whether or not you make money trading forex has nothing to do with how the broker manages their risk. It’s down to how well a trader calls the market.

If a broker hedges all client potions instantly then there should be no issue. Most Forex brokers that do this offer straight-through trading on MetaTrader 4. MT4 spread betting brokers tend to give clean prices and charge a commission. There is generally no conflict of interest and in these instances the brokers want the clients to make money.

Some brokers through don’t hedge all client positions. This isn’t because they are basically a bookie and want traders to lose all their money as they take the other side. The more reputable forex brokers only don’t hedge when it is not cost effective to do so.

Do brokers ban scalping because its profitable?

Some do yes.

It’s a bit of shame because brokers are really just supposed to provide access to the markets and nothing else.

Brokers ban scalping mainly because they are internalising orders or running a B-book against your trades. If you really want to take advantage of scalping, which is essentially high-frequency trading you need a Futures broker or CFD broker that offers DMA (Direct Market Access).

Always remember that trying to take tiny profits on tiny movements can result in big losses if the market moves against you quickly and you don’t have protection in place.

Compare brokers for scalping the forex markets

You can use this comparison table of forex brokers to see what scalping platforms offer CFDs, spread betting, how many fx pairs they offer, the minimum deposit and what they charge for financing longer term forex postions.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.