We have ranked, compared and reviewed some of the best brokers for indices trading in the UK to help you choose the most appropriate account for your trading strategy. Index brokers provide access to indices markets such as the FTSE, DAX, and S&P for the purposes of trading, speculation, and hedging. These indices are made up of individual shares traded on stock exchanges. For example, the FTSE 100 is an index of the biggest 100 publically listed shares traded on the London Stock Exchange.

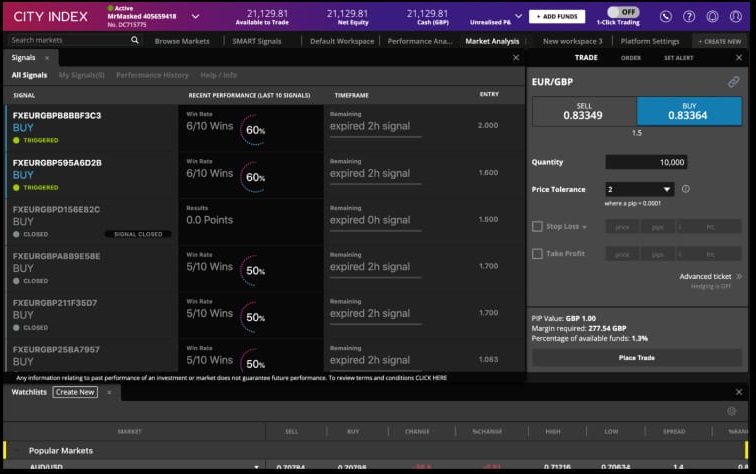

City Index: Best index trading tools

- Indices available: 40

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Index pricing: FTSE 1, DAX 1, Dow 3.5, NASDAQ 1, S&P 0.4

- GMG rating: (4.1)

- Customer rating: 3.6/5 (86 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Indices Trading Review

Name: City Index Indices Trading

Description: Trade major global indices at City Index like the UK 100, Wall Street and Germany 40. Choose a spread betting or CFD trading account and get tight spreads on European, US, Asian and Australian indices. City Index also provide trading signals through and post trade analytics to provide trading ideas and improve your performance.

70% of retail investor accounts lose money when trading CFDs with this provider

Summary

- Indices available: 40

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Index pricing: FTSE 1, DAX 1, Dow 3.5, NASDAQ 1, S&P 0.4

Pros

- Index trading signals

- Post-trade index analytics

- Good education and analysis program

Cons

- No DMA index trading

- Limited index options as a CFD or spread bet

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

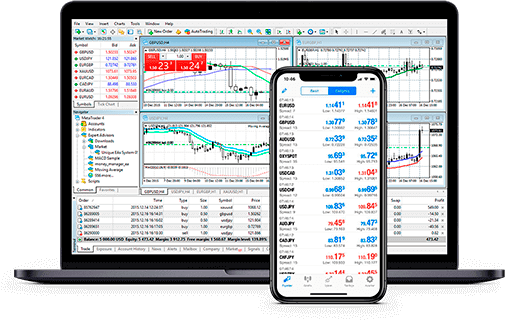

4.1Pepperstone: Best for MT4 & MT5 index trading

- Indices available: 28

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Index pricing: FTSE 1, DAX 1, Dow 2, NASDAQ 1, S&P 0.4

- GMG rating: (3.9)

- Customer rating: 4.6/5 (61 reviews)

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Indices Trading Review

Name: Pepperstone Indices Trading

Description: Pepperstone sources razor-sharp pricing, from multiple Tier 1 banks and liquidity providers, with competitive fixed spreads as low as 1 point on UK100, 0.9 on GER40, with no commissions. 99.99% fill rate*, fast execution and no dealing desk intervention. Quick and easy account opening. Apply for your trading account in few minutes.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Indices available: 28

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Index pricing: FTSE 1, DAX 1, Dow 2, NASDAQ 1, S&P 0.4

Pros

- Good for automated index trading

- Lots of indices on MT4 & MT5

- Tight index spreads

Cons

- No DMA index trading

- No index options

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(3.5)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

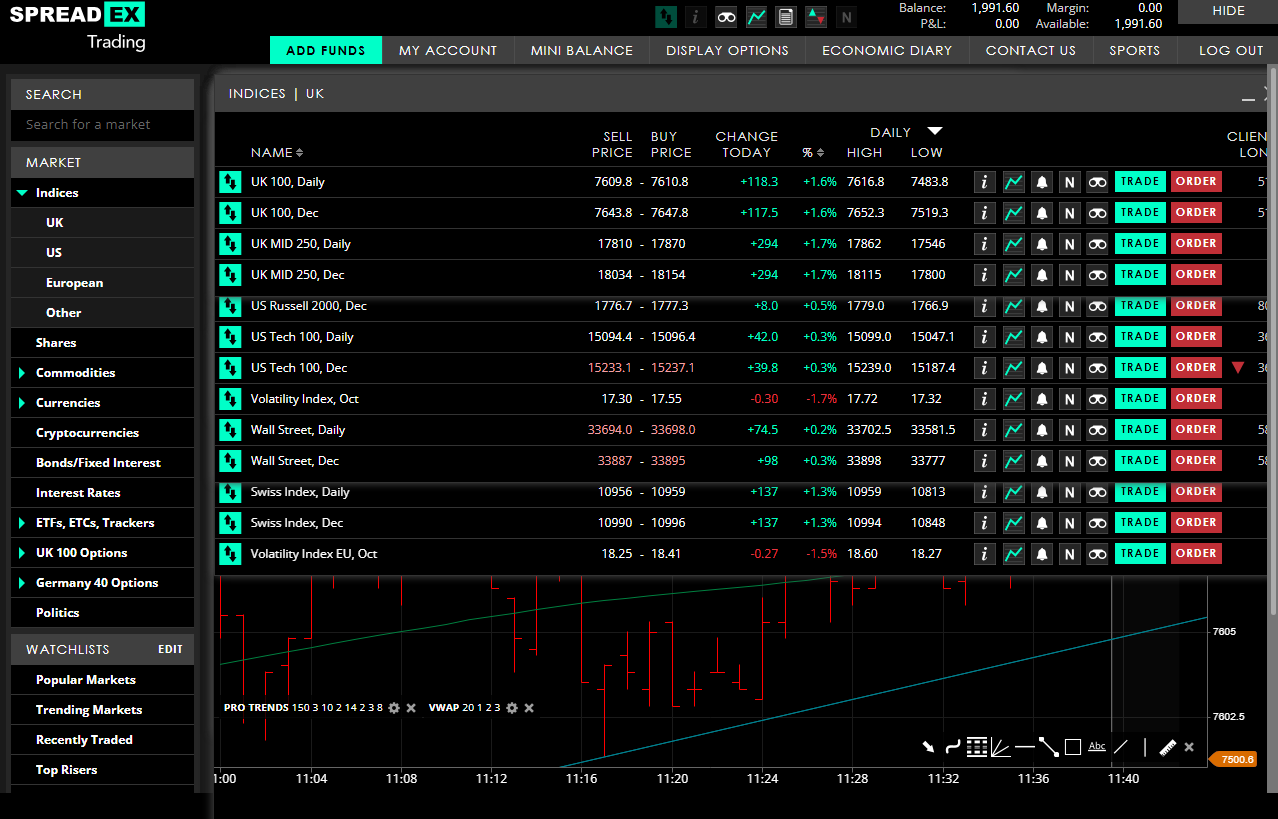

3.9Spreadex: Best index trading platform for customer service

- Indices available: 30

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Index pricing: FTSE 1, DAX 1, Dow 4, NASDAQ 2, S&P 0.6

- GMG rating: (4.2)

- Customer rating: 4.2/5 (177 reviews)

72% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Indices Trading Review

Name: Spreadex Indices Trading Review

Description: Spreadex offers 24 hour indices trading via financial spread betting or Contracts For Difference on the world’s major stock indices – with spreads on the most popular markets from 1pt on UK 100, 1pt on Germany 40 & 1.7pts on Wall Street.

72% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Indices available: 30

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Index pricing: FTSE 1, DAX 1, Dow 4, NASDAQ 2, S&P 0.6

Pros

- Excellent customer service

- Low minimum deposit

- Easy-to-use index trading platform

Cons

- Limited index options trading

- No DMA index trading

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

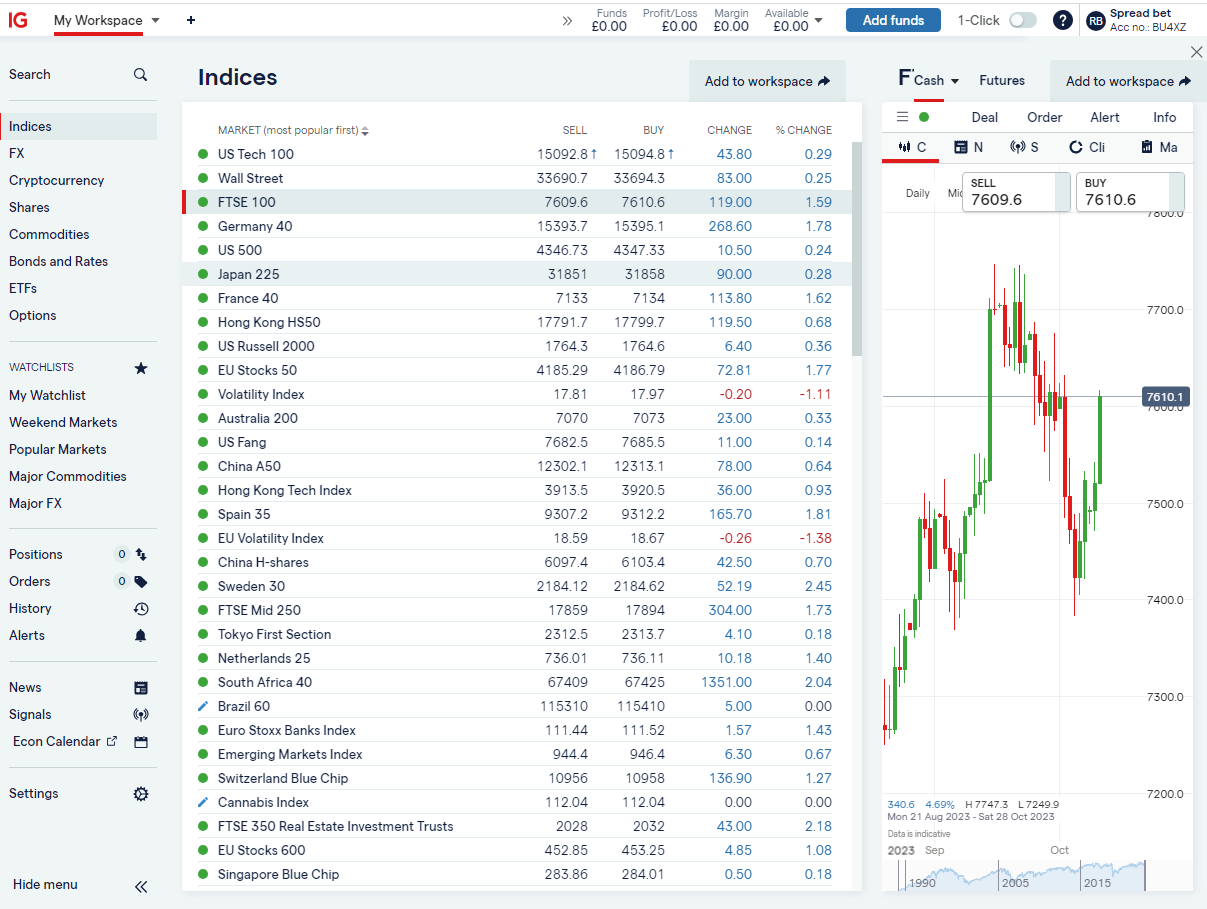

4.2IG: Best for index liquidity and high-volume traders

- Indices available: 80+

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Index pricing: FTSE 1, DAX 1, Dow 2.4, NASDAQ 1, S&P 0.4

- GMG rating: (4.2)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG Indices Trading Review

Name: IG Indices Trading

Description: Trade over 80 indices with the world’s No.1 spread betting and CFD provider. Trade with deep liquidity on spreads from 1 point on the FTSE 100, 1.2 on the Germany 40 and 0.4 on the US 500. IG also offers indices trading on weekends when the main markets are closed.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- Indices available: 80+

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Index pricing: FTSE 1, DAX 1, Dow 2.4, NASDAQ 1, S&P 0.4

Pros

- Excellent index liquidity

- Wide range of indices to trade

- Good index trading signals and analysis

Cons

- No index futures

- Index options only available as a CFD or spread bet

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

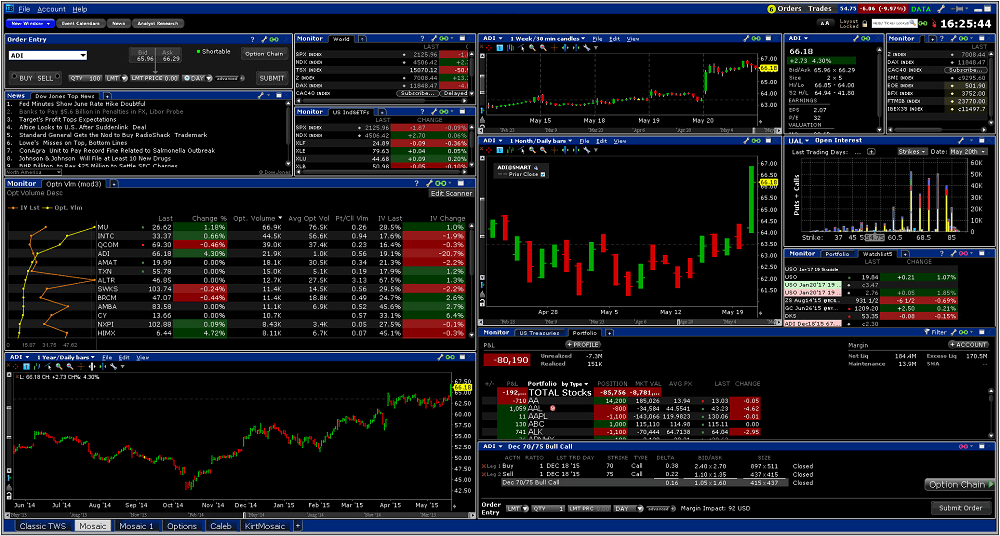

4.2Interactive Brokers: Best for on-exchange index trading

- Indices available: 13

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Index pricing: FTSE 0.005%, DAX 0.005%, Dow 0.005%, NASDAQ 0.005%, S&P 0.005%

- GMG rating: (4.2)

- Customer rating: 4.4/5 (758 reviews)

60% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers Indices Trading Review

Name: Interactive Brokers Indices Trading

Description: Interactive Brokers has transparent, low commissions and financing rates equity indices can be traded in lots as small as 1X the index level. Unlike the related futures, Index CFDs do not expire, saving rollover-related costs and risks.

60% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Indices available: 13

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Index pricing: FTSE 0.005%, DAX 0.005%, Dow 0.005%, NASDAQ 0.005%, S&P 0.005%

Pros

- Low-cost index trading

- On-exchange index futures and options

- Excellent index trading platform and apps

Cons

- No index financial spread betting

- No guaranteed stops

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(3.5)

-

Research & Analysis

(4)

Overall

4.2CMC Markets: Best for low-cost index CFD trading

- Indices available: 80+

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Index pricing: FTSE 1, DAX 1, Dow 2, NASDAQ 1, S&P 0.5

- GMG rating: (4)

- Customer rating: 3.6/5 (107 reviews)

74% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets Indices Trading Review

Name: CMC Markets Indices Trading

Description: CMC Markets lets you trade on over 80 cash and forward global indices based on the FTSE 100 and more, with leverage, on an award-winning spread betting and CFD platform. Trade indices with tight spreads, lightning-fast execution and the highest-rated customer service in the industry.

74% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Indices available: 80+

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Index pricing: FTSE 1, DAX 1, Dow 2, NASDAQ 1, S&P 0.5

Pros

- Excellent client index trading sentiment

- Tight spreads on major indices

- Very good index trading platform

Cons

- No index ETF investing

- No DMA index trading

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

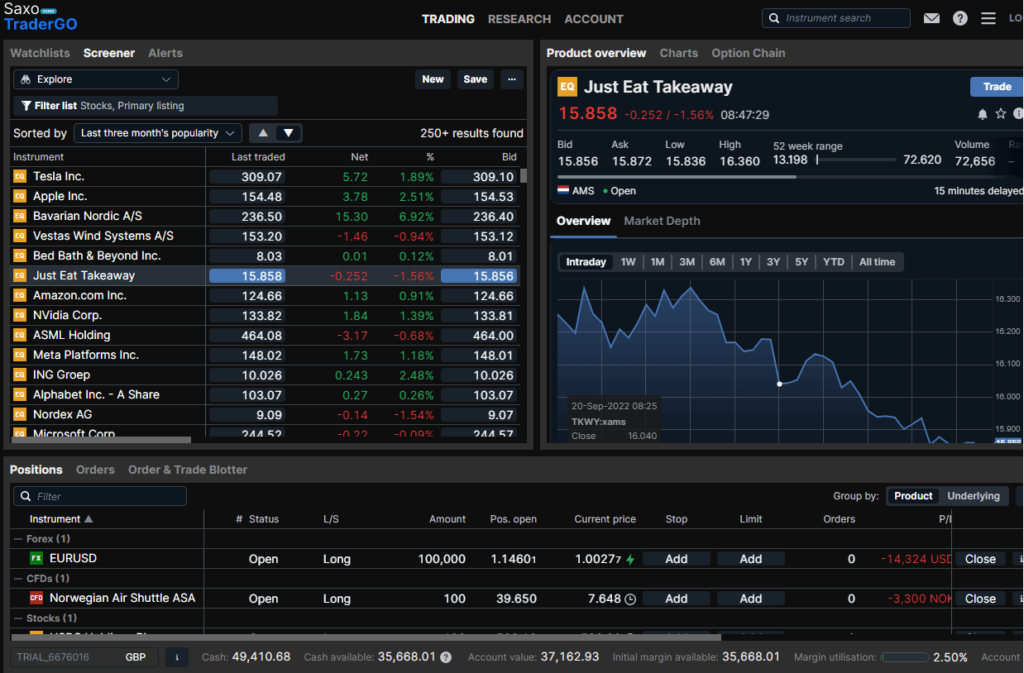

4Saxo Markets: Best for DMA indices trading

- Indices available: 29

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- Index pricing: FTSE 1, DAX 1, Dow 3, NASDAQ 1, S&P 0.5

- GMG rating: (4.3)

- Customer rating: 3.6/5 (52 reviews)

70% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets Indices Trading Review

Name: Saxo Markets Indices Trading

Description: With Saxo Markets you can trade 29 index-tracking CFDs with fast and reliable access to the markets from your phone, tablet, laptop or multi-screen desktop setup. The award-winning, multi-device SaxoTraderGO partners seamlessly with SaxoTraderPRO, giving a professional-grade platform for advanced index traders.

64% of retail investor accounts lose money when trading CFDs with this provider

Summary

- Indices available: 29

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- Index pricing: FTSE 1, DAX 1, Dow 3, NASDAQ 1, S&P 0.5

Pros

- DMA index trading

- Low commissions

- Excellent analysis and data

Cons

- No index spread betting

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.3XTB: Good Index trading educational material

- Indices available: 25

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: FTSE 1.7, DAX 1, Dow 3, NASDAQ 1, S&P 0.5

- GMG rating: (3.9)

- Customer rating: 4.7/5 (117 reviews)

81% of retail investor accounts lose money when trading CFDs with this provider

XTB Indices Trading Review

Name: XTB Indices Trading

Description: One of the good things about index trading with XTB, is that you can see market depth on the sidebar when trading indices. I’ve included that as a screenshot in the index trading platform tab below. This may not be such an issue if you are a smaller trader, but if you are dealing in size then people able to see what volume you will get filled in is very handy. You can also deal direct from the charts, so if you use the crosshairs function, you can quickly place orders around key support and resistance levels.

81% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Indices available: 25

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: FTSE 1.7, DAX 1, Dow 3, NASDAQ 1, S&P 0.5

Pros

- Multi-asset trading

- Competitively priced

- Lots of markets to trade

Cons

- Not UK HQ’d

- No basket trading

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

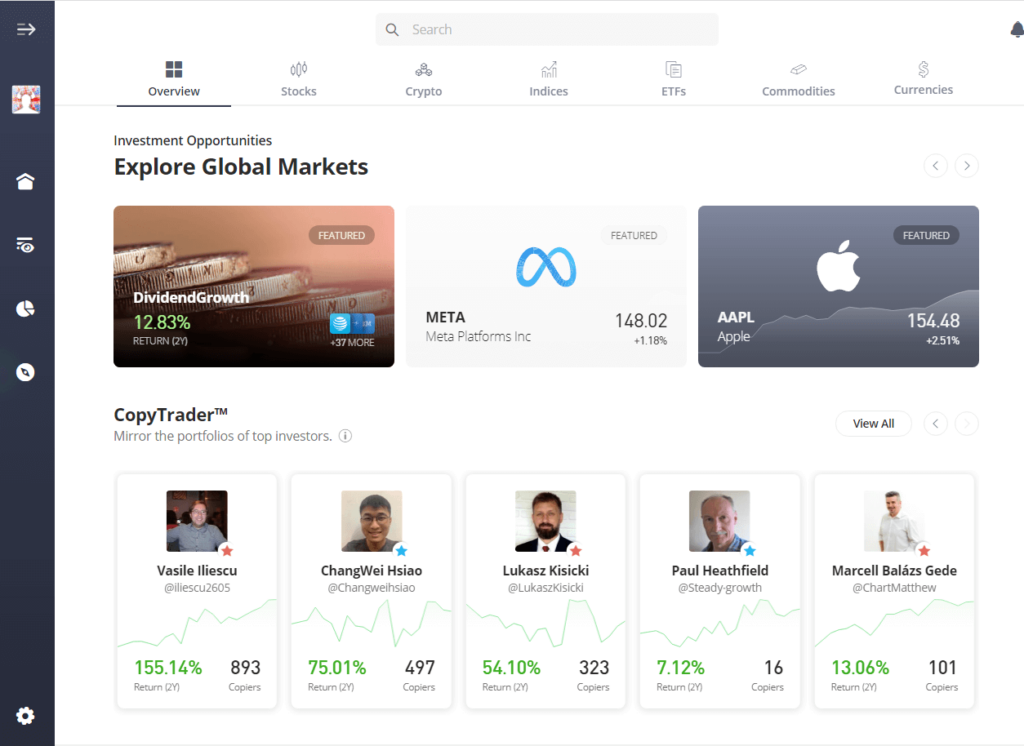

3.9eToro: Best for copying other index traders

- Indices available: 15

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Index pricing: FTSE 1, DAX 1.5, Dow 6, NASDAQ 2.4, S&P 0.75

- GMG rating: (3.6)

- Customer rating: 3.4/5 (223 reviews)

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Indices Trading Review

Name: eToro Indices Trading

Description: With eToro you can trade index CFDs or buy index-tracking ETFs. The social trading platform is easy to use and offers traders and investors the opportunity to trade a wide range of major stock indices as well as see and copy other traders positions.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Summary

- Indices available: 15

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Index pricing: FTSE 1, DAX 1.5, Dow 6, NASDAQ 2.4, S&P 0.75

Pros

- Social and copy index trading

- Easy-to-use platform

- Can change your index leverage

Cons

- Accounts must be in USD

- High FX conversion charges

- Index pricing can be wide

-

Pricing

(3.5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(3.5)

-

Research & Analysis

(3.5)

Overall

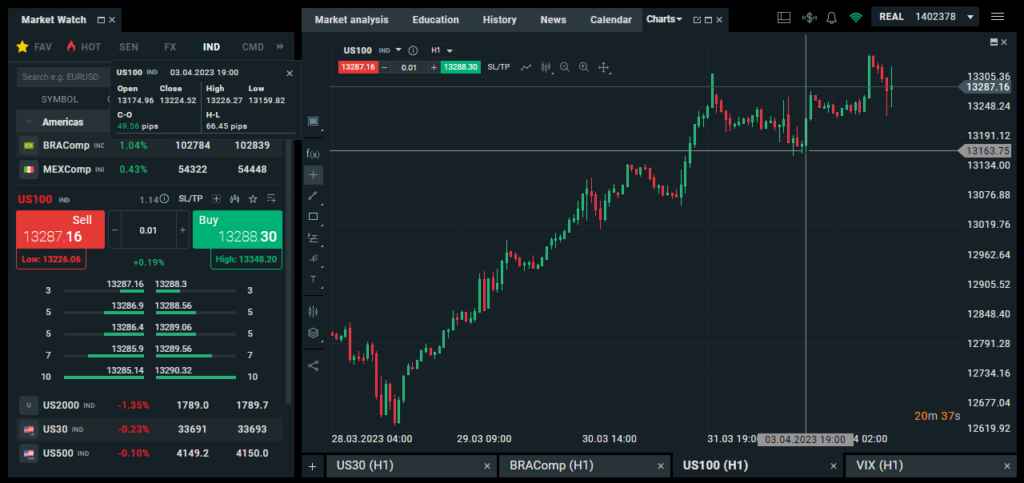

3.6Tickmill: Index trading micro futures on CQG

- Indices available: 10

- Minimum deposit: £100

- Account types: CFDs, futures

- Index pricing: FTSE 0.9, DAX 0.91, Dow 2.52, NASDAQ 1.93, S&P 0.39

- GMG rating: (3.9)

- Customer rating: 0.0/5 (0 reviews)

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Indices Trading Review

Name: Tickmill Indices Trading

Description: If you only want to trade the top ten indices as part of your overall trading, then Tickmill is a good option as they offer DMA futures trading on CQG as well as tight spreads on index CFDs on MT4 & MT5.

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- Indices available: 10

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Index pricing: FTSE 0.9, DAX 0.91, Dow 2.52, NASDAQ 1.93, S&P 0.39

Pros

- DMA index futures trading

- Low-cost CFD indices

- Lots of index trading platforms

Cons

- No UK shares

- Only the most popular indices

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

3.9Methodology: We have chosen what we think are the best brokers for indices based on:

- over 17,000 votes in our annual awards

- our own experiences testing the index trading platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the index broker CEOs and senior management

Compare Index Trading Platforms

| Index Trading Platform | Indices Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 40 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 28 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 80+ | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 30 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 29 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 13 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 25 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 80+ | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 15 | $10 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 10 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 40 | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 27 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

Beginners

City Index is a good broker for beginners as they have a simple trading platform with 40 major indices to trade as CFDs and spread bets. They also provide a lot of educational material, and have trading signal on indices which show potentially good times to buy and sell through two signal providers.

This matrix of index brokers shows which indices trading platform offer features that can benefit new traders.

| Beginner Features: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Signals | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Webinars | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Seminars | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Leverage Control | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Low-Risk Products | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Investment Account | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

Advanced & Professional Traders

Saxo Markets is the best broker for sophisticated and high-net-worth index traders as their platform is geared towards professional traders placing large orders. They also have some complex order functionality and direct markets access to global exchanges through futures and options.

This comparison table shows what index brokers offer functionality for advanced index traders.

| Advanced Features: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Algo Trading | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Prime Brokerage | ❌ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

Market Access

IG and CMC Markets both offer over 80 indices for trading as a spread bet or CFD.

This table shows which brokers offer access to the most indices as well as peripheral markets.

| Market Access: |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Markets | 12000 | 17000 | 11000 | 1200 | 9000 | 5233 | 10000 | 8,000 | 3700 | 2,100 |

| Forex Pairs | 84 | 51 | 338 | 62 | 182 | 100 | 54 | 20 | 138 | 57 |

| Commodities | 25 | 38 | 124 | 32 | 19 | 20 | 20 | 10 | 28 | 22 |

| Indices | 21 | 34 | 82 | 28 | 29 | 13 | 17 | 10 | 23 | 25 |

| UK Stocks | 3500 | 3925 | 745 | 192 | 5000 | 500 | 1575 | na | 450 | 230 |

| US Stocks | 1000 | 6352 | 4968 | 880 | 2000 | 3500 | 2110 | na | 1575 | 1080 |

| ETFs | n/a | 2000 | 1084 | 107 | 675 | 1100 | 160 | na | 0 | 138 |

Commissions & Fees

CMC Markets is one of the cheapest brokers for indices, with some of the tightest spreads for CFDs and spread betting on the major exchanges.

As well as our index cost comparison, you can use our trading fee calculator to see how much it will cost you to trade over a year with various different brokers.

| Trading Costs |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| FTSE 100 | 1 | 1 | 1 | 1 | 1 | 0.01% | 1 | 1 | 1 | 1.7 |

| DAX 30 | 1.2 | 1.2 | 1 | 0.9 | 1 | 0.01% | 1.2 | 1.2 | 1.8 | 1 |

| DJIA | 3.5 | 2.4 | 2 | 2.4 | 3 | 0.01% | 4 | 2.4 | 5 | 3 |

| NASDAQ | 1 | 1 | 1 | 1 | 1 | 0.01% | 2 | 1 | 1.9 | 1 |

| S&P 500 | 0.4 | 0.4 | 0.5 | 0.4 | 0.5 | 0.01% | 0.6 | 0.4 | 0.7 | 0.5 |

| EURUSD | 0.5 | 0.6 | 0.7 | 0.09 | 0.6 | 0.00% | 0.6 | 0.6 | 0.8 | 0.9 |

| GBPUSD | 0.9 | 0.9 | 0.9 | 0.28 | 0.7 | 0.00% | 0.9 | 0.9 | 1.3 | 1.4 |

| USDJPY | 0.6 | 0.7 | 0.7 | 0.14 | 0.6 | 0.00% | 0.7 | 0.7 | 0.8 | 1.4 |

| Gold | 0.8 | 0.3 | 0.3 | 0.05 | 0.6 | 0.00% | 0.4 | 0.3 | 0.28 | 0.35 |

| Crude Oil | 0.3 | 0.28 | 3 | 2 | 0.5 | 0.00% | 3 | 0.28 | 0.4 | 3 |

| UK Stocks | 0.008 | 0.001 | 0.001 | 0.001 | 0.0005 | 0.02% | 0.002 | 0.001 | 0.30% | 0.0008 |

Account Types

Saxo Markets provides the most ways to trade indices as they offer index CFDs as well as on exchange traded futures, options and ETFs. The only type of index trading Saxo Markets does not offer is spread betting, where profits are tax free in the UK. If you would like to trade indices as a spread bet IG also offer spread betting, CFDs and physical ETFs, although no DMA futures and options.

Use our comparison table of what we think are the best index trading platforms to compare how many indices they offer, commission and spreads on the most popular indices and what different types of account they offer.

| Account Types: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Spread Betting | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| DMA | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Investments | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Futures & Options | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

Index brokers provide access to stock market indices markets via:

- Index Futures– these index brokers provide professional traders with direct market access to indices traded on exchange.

- Index Options– these index brokers options trading to professional traders on-exchange. In some cases, stock brokers will offer index options for clients that want to hedge a portfolio.

- Index CFDs – these index brokers provide CFDs (contracts for difference) which are ideal for traders that want to trade in smaller size than index futures.

- Index Spread Betting – these index brokers let their clients bet on the price movements of an index. As trades are structured as bets, there is no capital gains tax due on index spread betting profits

- Index ETFs – Index ETFs are listed on stock exchanges and can be bought and sold in a similar way to shares and can track the price of an index. They are useful for investors that want exposure to an indices’ overall performance but do not want to buy an actively managed index fund or index derivatives. As they are listed on stock exchanges, they are available through share dealing platforms, CFD trading platforms and spread betting brokers.

⚠️ FCA Regulation

All index trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK index trading platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature index trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.

Index Trading Platform FAQ:

Indices are listed on futures exchanges like the ICE (International Continental Exchange) for FTSE futures and the CME (Chicago Mercantile Exchange) for E-mini S&P 500 futures. These future provide the basis, or underlying asset on which Index brokers enable their clients to trade indices.

The actual on-exchange futures contracts are mainly for professional and institutional traders as the minimum contract size is often quite high. For example, the FTSE future contract is valued at £10 x the index value. So at the time of writing (4/11/21) where the FTSE Index is valued at 7200, a single FTSE future is worth £72,000.

Yes, you can make money trading indices, but Index trading is a high risk. To successfully make money trading indices you will either have to invest in indices in the long term or call the market right in the short-term. It is worth keeping in mind that only around 25% of non-professional traders make money. but some are easier to trade than others.

Yes, as a financial instrument in the UK index trading is regulated by the FCA.

Yes, you can compare the best brokers for trading volatility here.

Index brokers make money through fees and financing charges. Index broker costs can be broken down depending on how an index is traded.

The different types of index broker make money in these ways

- Futures index brokers – commission charge on a per lot basis

- Options index brokers – commission charged on a per lot basis

- CFD index brokers – the bid/offer spread is widened and overnight interest is charged on positions

- Spread Betting index brokers- the bid/offer spread is widened and overnight interest is charged on positions

- ETF index brokers – commission charge on buys and sells, plus an account maintenance charge

Here is a list of the most popular stock markets to trade with an index broker. You can read more about each specific index, the pros and cons of trading and what economic factors move the market by either clicking on the below index links or reading our guide on the top ten stock market indices for trading and why.

The main things to consider when choosing an index broker are:

- Are they right for your level of experience?

- How many indices do they offer?

- What are the commissions and fees?

- How can you trade indices?

- What sort of added value does the broker offer?

- What trading platforms and mobile apps do they have?

In this guide to the best brokers for trading indices we will go through each point, highlight which broker is best for each point so you can make the best choice for the specific type of index trading you do.

By trading an index rather than the individual shares you can buy and sell the entire market in one go.

- Further reading: How to start index trading and our guide to the best indices for index trading.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the index brokers via a non-affiliate link, you can view their indices trading pages directly here: